| Zacks Company Profile for XPO, Inc. (XPO : NYSE) |

|

|

| |

| • Company Description |

| XPO Inc. is a provider of asset-based less-than-truckload transportation principally in North America, with proprietary technology which moves goods efficiently. XPO Inc., formerly known as XPO LOGISTICS, is headquartered in Greenwich, Conn.

Number of Employees: 37,000 |

|

|

| |

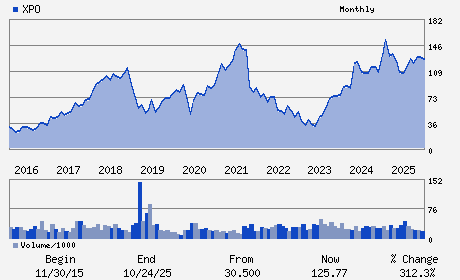

| • Price / Volume Information |

| Yesterday's Closing Price: $195.33 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,345,919 shares |

| Shares Outstanding: 117.15 (millions) |

| Market Capitalization: $22,882.39 (millions) |

| Beta: 2.01 |

| 52 Week High: $207.04 |

| 52 Week Low: $85.06 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

29.86% |

31.84% |

| 12 Week |

47.38% |

42.36% |

| Year To Date |

43.72% |

43.92% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

5 AMERICAN LANE

-

GREENWICH,CT 06831

USA |

ph: 855-976-6951

fax: 269-695-7458 |

investors@xpo.com |

http://www.xpo.com |

|

|

| |

| • General Corporate Information |

Officers

Mario Harik - Chairman and Chief Executive Officer

Allison Landry - Vice Chair of the Board of Directors

Kyle Wismans - Chief Financial Officer

Christopher Brown - Chief Accounting Officer

Bella Allaire - Director

|

|

Peer Information

XPO, Inc. (DMSC)

XPO, Inc. (CVLG)

XPO, Inc. (IRNE)

XPO, Inc. (CDV)

XPO, Inc. (ARCB)

XPO, Inc. (CEXP)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: TRANS-TRUCK

Sector: Transportation

CUSIP: 983793100

SIC: 4700

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 117.15

Most Recent Split Date: 9.00 (0.25:1)

Beta: 2.01

Market Capitalization: $22,882.39 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.88 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $4.46 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 10.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 17.07% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |