| Zacks Company Profile for XWELL, Inc. (XWEL : NSDQ) |

|

|

| |

| • Company Description |

| XWELL Inc. is a health and wellness holding company. Its operating brands include XpresCheck(R), XpresSpa(R), Treat(TM) and HyperPointe. XpresSpa is a retailer of wellness services and related products. Treat is a travel health and wellness brand. XpresCheck is a provider of Covid-19 screening and diagnostic testing in partnership with the CDC and Concentric by Ginkgo. HyperPointe is a digital healthcare and data analytics relationship company. XWELL Inc., formerly known as XpresSpa Group Inc., is based in NEW YORK.

Number of Employees: 312 |

|

|

| |

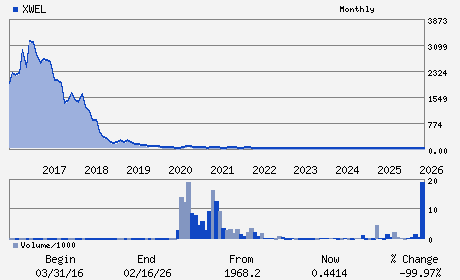

| • Price / Volume Information |

| Yesterday's Closing Price: $0.44 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,488,147 shares |

| Shares Outstanding: 5.77 (millions) |

| Market Capitalization: $2.55 (millions) |

| Beta: 1.51 |

| 52 Week High: $1.42 |

| 52 Week Low: $0.26 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

12.03% |

13.73% |

| 12 Week |

-41.15% |

-43.15% |

| Year To Date |

-4.21% |

-4.08% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

254 WEST 31ST STREET 11TH FLOOR

-

NEW YORK,NY 10001

USA |

ph: 212-750-9595

fax: 309-410-3967 |

ir@xwell.com |

http://www.xwell.com |

|

|

| |

| • General Corporate Information |

Officers

Ezra T. Ernst - Chief Executive Officer and Director

Ian Brown - Chief Financial Officer

Bruce T. Bernstein - Director

Robert Weinstein - Director

Michael Lebowitz - Director

|

|

Peer Information

XWELL, Inc. (CHCR)

XWELL, Inc. (ESRX)

XWELL, Inc. (MYDP)

XWELL, Inc. (COR)

XWELL, Inc. (GBCS)

XWELL, Inc. (LAXAF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Medical Services

Sector: Medical

CUSIP: 98420U802

SIC: 7200

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 04/21/26

|

|

Share - Related Items

Shares Outstanding: 5.77

Most Recent Split Date: 9.00 (0.05:1)

Beta: 1.51

Market Capitalization: $2.55 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $ |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/21/26 |

|

|

|

| |