| Zacks Company Profile for Abercrombie & Fitch Company (ANF : NYSE) |

|

|

| |

| • Company Description |

| Abercrombie & Fitch Co. operates as a specialty retailer of all types of premium, high-quality casual apparel for men, women, and kids through a vast store network across N. America, Europe, Asia and the Middle East under the Abercrombie & Fitch, abercrombie kids and Hollister brands. Also, the company sells inner wear, personal care products, sleepwear and at-home products for girls through direct-to-consumer operations and Hollister stores under the Gilly Hicks brand. It also sells products through its e-commerce platform. Region-wise it reports its sales under two segments - U.S. Stores (U.S. and Puerto Rico) and International Stores (Canada, Europe, Asia, Australia and the Middle East). Brand-wise, Abercrombie reports in 2 segments - Abercrombie and Hollister. Abercrombie includes the Abercrombie & Fitch and abercrombie kids brands. Hollister is based on a South California theme, and targets youth in their late teens. Stores under this brand also offer intimate products of the Gilly Hicks brand.

Number of Employees: 39,200 |

|

|

| |

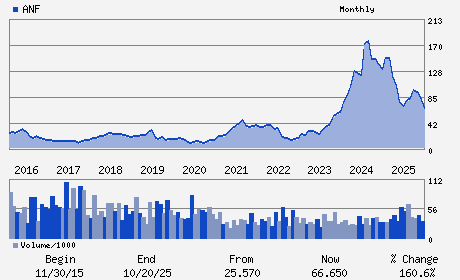

| • Price / Volume Information |

| Yesterday's Closing Price: $95.68 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,272,597 shares |

| Shares Outstanding: 45.86 (millions) |

| Market Capitalization: $4,387.65 (millions) |

| Beta: 1.19 |

| 52 Week High: $133.11 |

| 52 Week Low: $65.40 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-3.36% |

-3.44% |

| 12 Week |

0.57% |

-0.44% |

| Year To Date |

-23.99% |

-24.38% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Fran Horowitz - Chief Executive Officer and Director

Nigel Travis - Chairperson of the Board

Robert J. Ball - Senior Vice President; Chief Financial Officer

Joseph Frericks - Group Vice President; Corporate Controller

James A. Goldman - Director

|

|

Peer Information

Abercrombie & Fitch Company (CACH)

Abercrombie & Fitch Company (DXLG)

Abercrombie & Fitch Company (HIBB)

Abercrombie & Fitch Company (WALKQ)

Abercrombie & Fitch Company (BDST)

Abercrombie & Fitch Company (CBKCQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-APP/SHOE

Sector: Retail/Wholesale

CUSIP: 002896207

SIC: 5651

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/04/26

|

|

Share - Related Items

Shares Outstanding: 45.86

Most Recent Split Date: 6.00 (2.00:1)

Beta: 1.19

Market Capitalization: $4,387.65 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.50 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $10.07 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/04/26 |

|

|

|

| |