| Zacks Company Profile for Caleres, Inc. (CAL : NYSE) |

|

|

| |

| • Company Description |

| Caleres, Inc. is a footwear retailer and wholesaler. The Company is involved in the operation of retail shoe stores and e-commerce Websites as well as the design, sourcing and marketing of footwear for women and men. Its operating segment consists of Famous Footwear and Brand Portfolio. The company brands include Nike, Skechers, Bearpaw, Converse, Vans, New Balance, adidas, Asics, Sperry and Sof Sole, LifeStride, Dr. Scholl's, Fergalicious, Naturalizer and Carlos. Caleres, Inc., formerly known as Brown Shoe Company, Inc., is headquartered in St. Louis, Missouri.

Number of Employees: 9,400 |

|

|

| |

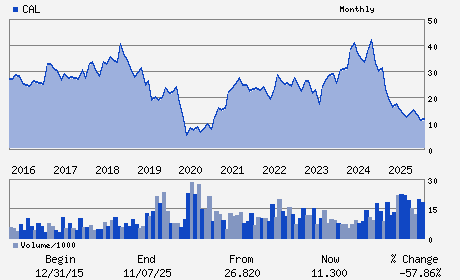

| • Price / Volume Information |

| Yesterday's Closing Price: $11.81 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 529,346 shares |

| Shares Outstanding: 33.90 (millions) |

| Market Capitalization: $400.31 (millions) |

| Beta: 0.64 |

| 52 Week High: $18.27 |

| 52 Week Low: $9.54 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-14.30% |

-12.94% |

| 12 Week |

22.64% |

17.30% |

| Year To Date |

-2.96% |

-4.51% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

John W. Schmidt - Chief Executive Officer

Diane M. Sullivan - Executive Chair

Jack P. Calandra - Chief Financial Officer

Todd E. Hasty - Senior Vice President and Chief Accounting Officer

Lisa A. Flavin - Director

|

|

Peer Information

Caleres, Inc. (RCSFY)

Caleres, Inc. (BIRK)

Caleres, Inc. (SRR)

Caleres, Inc. (TBL)

Caleres, Inc. (SHOO)

Caleres, Inc. (DFZ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: SHOES&REL APPRL

Sector: Consumer Discretionary

CUSIP: 129500104

SIC: 3140

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/19/26

|

|

Share - Related Items

Shares Outstanding: 33.90

Most Recent Split Date: 4.00 (1.50:1)

Beta: 0.64

Market Capitalization: $400.31 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.37% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.28 |

Indicated Annual Dividend: $0.28 |

| Current Fiscal Year EPS Consensus Estimate: $1.67 |

Payout Ratio: 0.18 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.07 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/26/2025 - $0.07 |

| Next EPS Report Date: 03/19/26 |

|

|

|

| |