| Zacks Company Profile for BRP Inc. (DOO : NSDQ) |

|

|

| |

| • Company Description |

| BRP Inc. designs, develops, manufactures and distributes recreational vehicles. The Company offers watercrafts, sport boats, snowmobiles, pontoons, marine propulsion systems and all-terrain and utility vehicles, as well as engines for karts, motorcycles and recreational aircrafts. BRP Inc. is headquartered in Valcourt, Canada.

Number of Employees: 16,500 |

|

|

| |

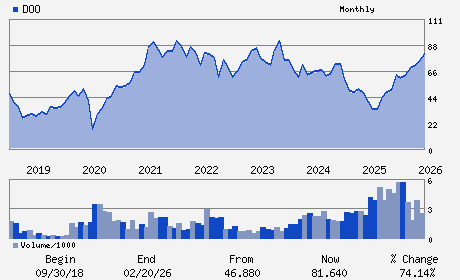

| • Price / Volume Information |

| Yesterday's Closing Price: $81.64 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 135,652 shares |

| Shares Outstanding: 73.35 (millions) |

| Market Capitalization: $5,988.62 (millions) |

| Beta: 1.23 |

| 52 Week High: $81.89 |

| 52 Week Low: $31.78 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.24% |

1.30% |

| 12 Week |

17.86% |

16.20% |

| Year To Date |

15.38% |

13.15% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Jose Boisjoli - President and Chief Executive Officer

Sebastien Martel - Chief Financial Officer

Michael Hanley - Director

Daniel J. O`neill - Director

Louis Laporte - Director

|

|

Peer Information

BRP Inc. (M.BUD)

BRP Inc. (DCNAQ)

BRP Inc. (CGUL)

BRP Inc. (DAN)

BRP Inc. (CTTAY)

BRP Inc. (M.DEC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AUTO/TRUCK-ORIG

Sector: Auto/Tires/Trucks

CUSIP: 05577W200

SIC: 3790

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/25/26

|

|

Share - Related Items

Shares Outstanding: 73.35

Most Recent Split Date: (:1)

Beta: 1.23

Market Capitalization: $5,988.62 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.77% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.75 |

Indicated Annual Dividend: $0.63 |

| Current Fiscal Year EPS Consensus Estimate: $4.39 |

Payout Ratio: 0.22 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.11 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/31/2025 - $0.16 |

| Next EPS Report Date: 03/25/26 |

|

|

|

| |