| Zacks Company Profile for Heritage Commerce Corp (HTBK : NSDQ) |

|

|

| |

| • Company Description |

| Heritage Commerce Corp. is the holding company of Heritage Bank of Commerce, Heritage Bank East Bay, Heritage Bank South Valley and Bank of Los Altos. The company offers a range of loans, primarily commercial, including real estate, construction, Small Business Administration), inventory and accounts receivable, and equipment loans. The company also accepts checking, savings, and time deposits; NOW and money market deposit accounts; and provides travelers' checks, safe deposit, and other customary non-deposit banking services.

Number of Employees: 355 |

|

|

| |

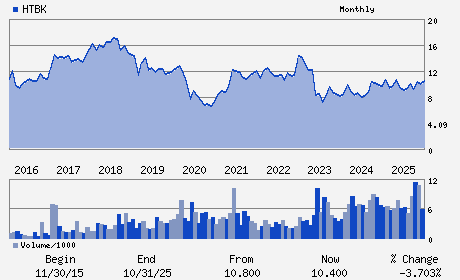

| • Price / Volume Information |

| Yesterday's Closing Price: $13.41 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 605,044 shares |

| Shares Outstanding: 61.56 (millions) |

| Market Capitalization: $825.51 (millions) |

| Beta: 0.80 |

| 52 Week High: $13.83 |

| 52 Week Low: $8.09 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-0.37% |

-0.45% |

| 12 Week |

21.91% |

20.69% |

| Year To Date |

11.66% |

11.08% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Robertson Clay Jones - Chief Executive Officer and Director

Jack W. Conner - Chairman of the Board and Director

Julianne M. Biagini-Komas - Vice Chairman of the Board and Director

Thomas A. Sa - Executive Vice President and Chief Operating Offic

Bruce H. Cabral - Director

|

|

Peer Information

Heritage Commerce Corp (CACB)

Heritage Commerce Corp (CPF)

Heritage Commerce Corp (FMBL)

Heritage Commerce Corp (GRGN.)

Heritage Commerce Corp (EVRT)

Heritage Commerce Corp (EWBC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-WEST

Sector: Finance

CUSIP: 426927109

SIC: 6022

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 61.56

Most Recent Split Date: (:1)

Beta: 0.80

Market Capitalization: $825.51 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.88% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.23 |

Indicated Annual Dividend: $0.52 |

| Current Fiscal Year EPS Consensus Estimate: $0.98 |

Payout Ratio: 0.57 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: -0.04 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 02/05/2026 - $0.13 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |