| Zacks Company Profile for NetApp, Inc. (NTAP : NSDQ) |

|

|

| |

| • Company Description |

| NetApp provides enterprise storage as well as data management software and hardware products and services. The company's product line comprises two storage platforms - FAS storage platform and E-Series platform. The company's all-flash storage portfolio comprises NVMe-based storage systems and new cloud-based services in order to provide hybrid storage architecture. FAS Storage Platform is based on the NetApp Data ONTAP operating system, which combines storage efficiency, data management and data protection. The FAS product line includes FAS6200, FAS3200 and FAS2000 series. The E-series platform helps in the deployment of Hadoop Big Data infrastructure. The E-series product line comprises EF540 Flash Array and EF550.The company's Cloud Volumes ONTAP storage data management service helps in data protection and storage competence.

Number of Employees: 11,700 |

|

|

| |

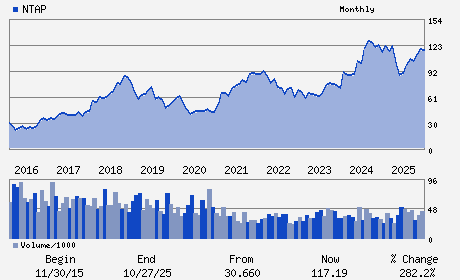

| • Price / Volume Information |

| Yesterday's Closing Price: $101.60 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,331,014 shares |

| Shares Outstanding: 198.06 (millions) |

| Market Capitalization: $20,122.93 (millions) |

| Beta: 1.38 |

| 52 Week High: $127.78 |

| 52 Week Low: $71.84 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

2.37% |

3.14% |

| 12 Week |

-7.00% |

-7.67% |

| Year To Date |

-5.13% |

-5.35% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

George Kurian - Chief Executive Officer and Director

T. Michael Nevens - Chairman

Cesar Cernuda - President

Wissam Jabre - Executive Vice President and Chief Financial Offic

Elizabeth M. O`Callahan - Executive Vice President; Chief Administrative Off

|

|

Peer Information

NetApp, Inc. (CPCIQ)

NetApp, Inc. (SNDK)

NetApp, Inc. (CBEX)

NetApp, Inc. (DTLK)

NetApp, Inc. (LCRD)

NetApp, Inc. (FLSH)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: COMP-STORAGE DE

Sector: Computer and Technology

CUSIP: 64110D104

SIC: 3572

|

|

Fiscal Year

Fiscal Year End: April

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 02/26/26

|

|

Share - Related Items

Shares Outstanding: 198.06

Most Recent Split Date: 3.00 (2.00:1)

Beta: 1.38

Market Capitalization: $20,122.93 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.05% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.84 |

Indicated Annual Dividend: $2.08 |

| Current Fiscal Year EPS Consensus Estimate: $6.38 |

Payout Ratio: 0.35 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: -0.09 |

| Estmated Long-Term EPS Growth Rate: 7.14% |

Last Dividend Paid: 01/02/2026 - $0.52 |

| Next EPS Report Date: 02/26/26 |

|

|

|

| |