| Zacks Company Profile for Agilent Technologies, Inc. (A : NYSE) |

|

|

| |

| • Company Description |

| Agilent Technologies, Inc. is an original equipment manufacturer of a broad-based portfolio of test and measurement products serving multiple end markets. Recently, the company has diversified into new end markets, namely industrial, chemical and electronics markets. The company has three business segments, including Life Sciences & Applied Markets Group (LSAG), Diagnostics and Genomics Group (DGG) and Agilent Cross Lab Group (ACG).The company uses a direct sales model for the distribution of its products, which is supplemented by distributors, resellers, manufacturers' representatives, telesales and electronic commerce, as necessary.

Number of Employees: 18,100 |

|

|

| |

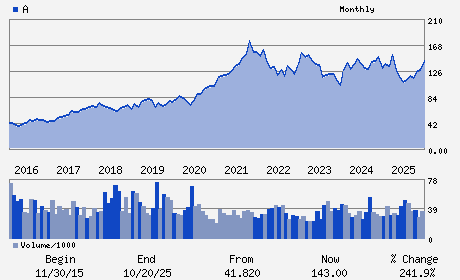

| • Price / Volume Information |

| Yesterday's Closing Price: $121.38 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,415,785 shares |

| Shares Outstanding: 282.84 (millions) |

| Market Capitalization: $34,331.08 (millions) |

| Beta: 1.31 |

| 52 Week High: $160.27 |

| 52 Week Low: $96.43 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-9.32% |

-8.52% |

| 12 Week |

-16.57% |

-16.67% |

| Year To Date |

-10.80% |

-11.23% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Padraig McDonnell - Chief Executive Officer;President and Director

Koh Boon Hwee - Chairman

Adam S. Elinoff - Senior Vice President and Chief Financial Officer

Rodney Gonsalves - Vice President and Corporate Controllership

Mala Anand - Director

|

|

Peer Information

Agilent Technologies, Inc. (BJCT)

Agilent Technologies, Inc. (CADMQ)

Agilent Technologies, Inc. (APNO)

Agilent Technologies, Inc. (UPDC)

Agilent Technologies, Inc. (IMTIQ)

Agilent Technologies, Inc. (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 00846U101

SIC: 3826

|

|

Fiscal Year

Fiscal Year End: October

Last Reported Quarter: 01/01/26

Next Expected EPS Date: 05/27/26

|

|

Share - Related Items

Shares Outstanding: 282.84

Most Recent Split Date: (:1)

Beta: 1.31

Market Capitalization: $34,331.08 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.84% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.41 |

Indicated Annual Dividend: $1.02 |

| Current Fiscal Year EPS Consensus Estimate: $5.95 |

Payout Ratio: 0.18 |

| Number of Estimates in the Fiscal Year Consensus: 8.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 7.99% |

Last Dividend Paid: 01/06/2026 - $0.25 |

| Next EPS Report Date: 05/27/26 |

|

|

|

| |