| Zacks Company Profile for AbbVie Inc. (ABBV : NYSE) |

|

|

| |

| • Company Description |

| AbbVie has become one of the top-most pharma companies after it acquired Allergan. The deal has transformed AbbVie's portfolio by lowering its dependence on Humira, its flagship product. AbbVie has one of the most popular cancer drugs in its portfolio, Imbruvica and its newest immunology drugs Skyrizi and Rinvoq position it well for long-term growth. AbbVie came into existence after Abbott Laboratories divested its pharmaceutical division. AbbVie enjoys leadership positions in key therapeutic areas including immunology, hematologic oncology, neuroscience, aesthetics, eye care and womens' health. Humira is approved for several autoimmune diseases like rheumatoid arthritis, active psoriatic arthritis, active ankylosing spondylitis, Crohn's disease and others. Imbruvica became part of the company's portfolio following the Pharmacyclics acquisition. Other key drugs include Venclexta, Botox Cosmetic, Botox Therapeutics, Vraylar, Skyrizi and Rinvoq.

Number of Employees: 57,000 |

|

|

| |

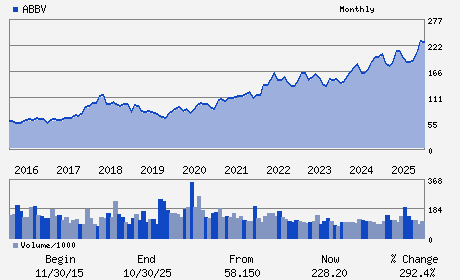

| • Price / Volume Information |

| Yesterday's Closing Price: $232.08 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 6,888,984 shares |

| Shares Outstanding: 1,768.17 (millions) |

| Market Capitalization: $410,356.66 (millions) |

| Beta: 0.34 |

| 52 Week High: $244.81 |

| 52 Week Low: $164.39 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.07% |

4.98% |

| 12 Week |

2.65% |

2.53% |

| Year To Date |

1.57% |

1.08% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1 NORTH WAUKEGAN ROAD

-

NORTH CHICAGO,IL 60064

USA |

ph: 847-932-7900

fax: 302-655-5049 |

None |

http://www.abbvie.com |

|

|

| |

| • General Corporate Information |

Officers

Robert A. Michael - Chairman of the Board and Chief Executive Officer

Scott T. Reents - Executive Vice President; Chief Financial Officer

David R. Purdue - Senior Vice President; Controller

Brett J. Hart - Director

Thomas J. Falk - Director

|

|

Peer Information

AbbVie Inc. (AGN.)

AbbVie Inc. (NVS)

AbbVie Inc. (NVO)

AbbVie Inc. (LLY)

AbbVie Inc. (RHHBY)

AbbVie Inc. (JNJ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Large Cap Pharma

Sector: Medical

CUSIP: 00287Y109

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/24/26

|

|

Share - Related Items

Shares Outstanding: 1,768.17

Most Recent Split Date: (:1)

Beta: 0.34

Market Capitalization: $410,356.66 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.98% |

| Current Fiscal Quarter EPS Consensus Estimate: $3.01 |

Indicated Annual Dividend: $6.92 |

| Current Fiscal Year EPS Consensus Estimate: $14.60 |

Payout Ratio: 0.66 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: 0.14 |

| Estmated Long-Term EPS Growth Rate: 19.69% |

Last Dividend Paid: 01/16/2026 - $1.73 |

| Next EPS Report Date: 04/24/26 |

|

|

|

| |