| Zacks Company Profile for Abbott Laboratories (ABT : NYSE) |

|

|

| |

| • Company Description |

| Abbott Labs discovers, develops, manufactures & sells a diversified line of health care products. Established Pharmaceuticals Division includes branded generics business in the emerging markets. Medical Devices unit includes the diabetes care, vision care & vascular businesses. Diagnostics unit manufactures and markets diagnostic systems and tests in four business lines core laboratory, molecular, point of care and rapid diagnostics. Nutrition unit includes a broad line of pediatric and adult nutritional products. Abbott acquired CFR Pharmaceuticals, Tendyne Holdings, Inc., St. Jude Medical and Alere Inc. On the other hand, Abbott sold its developed markets branded generics pharmaceuticals business to Mylan. Abbott retained the branded generics pharmaceuticals business in emerging markets. Abbott sold its animal health business to Zoetis Inc and divested its vision care business, Medical Optics, to Johnson & Johnson.

Number of Employees: 115,000 |

|

|

| |

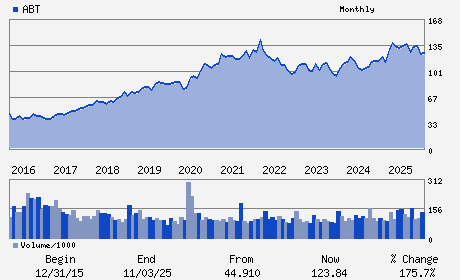

| • Price / Volume Information |

| Yesterday's Closing Price: $116.35 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 9,388,521 shares |

| Shares Outstanding: 1,737.68 (millions) |

| Market Capitalization: $202,179.41 (millions) |

| Beta: 0.74 |

| 52 Week High: $141.23 |

| 52 Week Low: $105.27 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.45% |

7.38% |

| 12 Week |

-6.98% |

-7.09% |

| Year To Date |

-7.14% |

-7.59% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

100 ABBOTT PARK ROAD

-

ABBOTT PARK,IL 60064

USA |

ph: 224-667-6100

fax: 847-937-1511 |

None |

http://www.abbott.com |

|

|

| |

| • General Corporate Information |

Officers

Robert B. Ford - Chief Executive Officer and Chairman of the Board

Philip P. Boudreau - Executive Vice President; Finance and Chief Financ

John A. McCoy - Vice President; Finance and Controller

Claire Babineaux-Fontenot - Director

Darren W. McDew - Director

|

|

Peer Information

Abbott Laboratories (BJCT)

Abbott Laboratories (CADMQ)

Abbott Laboratories (APNO)

Abbott Laboratories (UPDC)

Abbott Laboratories (IMTIQ)

Abbott Laboratories (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 002824100

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/15/26

|

|

Share - Related Items

Shares Outstanding: 1,737.68

Most Recent Split Date: 6.00 (2.00:1)

Beta: 0.74

Market Capitalization: $202,179.41 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.17% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.15 |

Indicated Annual Dividend: $2.52 |

| Current Fiscal Year EPS Consensus Estimate: $5.68 |

Payout Ratio: 0.46 |

| Number of Estimates in the Fiscal Year Consensus: 13.00 |

Change In Payout Ratio: 0.03 |

| Estmated Long-Term EPS Growth Rate: 11.07% |

Last Dividend Paid: 01/15/2026 - $0.63 |

| Next EPS Report Date: 04/15/26 |

|

|

|

| |