| Zacks Company Profile for Automatic Data Processing, Inc. (ADP : NSDQ) |

|

|

| |

| • Company Description |

| Automatic Data Processing, Inc. is one of the leading providers of cloud-based Human Capital Management (HCM) technology solutions - including payroll, talent management, Human Resources and benefits administration, and time and attendance management - to employers around the world. The company delivers it's global HCM strategy and make investments in highly strategic areas and technology in order to strengthen its underlying business model and prospects for continued growth. ADP has two reportable business segments: Employer Services and Professional Employer Organization Services. The Employer Services segment offers a comprehensive suite of HRO and technology-based HCM solutions. The Professional Employer Organization Services segment provides small and medium-sized businesses with employment administration outsourcing solutions.

Number of Employees: 67,000 |

|

|

| |

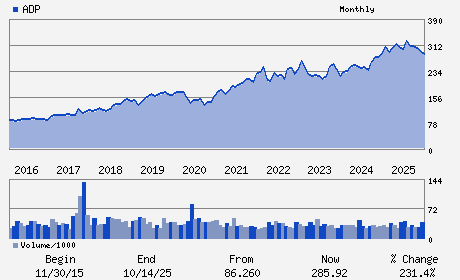

| • Price / Volume Information |

| Yesterday's Closing Price: $214.36 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,963,887 shares |

| Shares Outstanding: 402.64 (millions) |

| Market Capitalization: $86,310.84 (millions) |

| Beta: 0.86 |

| 52 Week High: $329.93 |

| 52 Week Low: $203.26 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-13.15% |

-12.39% |

| 12 Week |

-18.07% |

-18.17% |

| Year To Date |

-16.67% |

-17.07% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Maria Black - Chief Executive Officer and President

Peter Hadley - Chief Financial Officer

John P. Jones - Director

Peter Bisson - Director

David V. Goeckeler - Director

|

|

Peer Information

Automatic Data Processing, Inc. (ADP)

Automatic Data Processing, Inc. (CWLD)

Automatic Data Processing, Inc. (CYBA.)

Automatic Data Processing, Inc. (ZVLO)

Automatic Data Processing, Inc. (AZPN)

Automatic Data Processing, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 053015103

SIC: 7374

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 402.64

Most Recent Split Date: 1.00 (2.00:1)

Beta: 0.86

Market Capitalization: $86,310.84 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.17% |

| Current Fiscal Quarter EPS Consensus Estimate: $3.30 |

Indicated Annual Dividend: $6.80 |

| Current Fiscal Year EPS Consensus Estimate: $10.96 |

Payout Ratio: 0.65 |

| Number of Estimates in the Fiscal Year Consensus: 9.00 |

Change In Payout Ratio: 0.03 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/12/2025 - $1.70 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |