| Zacks Company Profile for Andritz (ADRZY : OTC) |

|

|

| |

| • Company Description |

| Andritz AG is engages in the provision of plants, equipment and services for hydropower stations. Its operating segment consists of Hydro; Pulp & Paper; Metals and Separation. Hydro segment installs and offers electromechanical systems, pumps and hydropower equipment. Pulp & Paper segment manufactures and trades tissue, board and paper products. Metals segment processes cold-rolled carbon steel, metal strip and stainless steel. Separation segment produces belts, screw passes, screens, drains cantrifuges, discs, drum filters, filter presses, separators, thickeners, flocculent systems and thermal systems. Andritz AG is headquartered in Graz, Austria.

Number of Employees: 30,003 |

|

|

| |

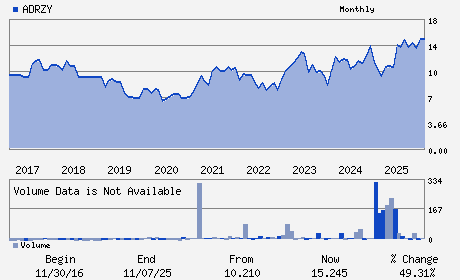

| • Price / Volume Information |

| Yesterday's Closing Price: $17.77 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 615 shares |

| Shares Outstanding: 520.00 (millions) |

| Market Capitalization: $9,240.40 (millions) |

| Beta: 0.97 |

| 52 Week High: $18.81 |

| 52 Week Low: $10.79 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.54% |

2.94% |

| 12 Week |

19.35% |

18.74% |

| Year To Date |

16.37% |

15.76% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Joachim Schonbeck - President and Chief Executive Officer

Norbert Nettesheim - Chief Financial Officer

Frederic Sauze - Director

Dietmar Heinisser - Director

Jarno Matias Nymark - Director

|

|

Peer Information

Andritz (BOOM)

Andritz (AMBIQ)

Andritz (DSGR)

Andritz (MSM)

Andritz (SIEGY)

Andritz (MATTQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Industrial Services

Sector: Industrial Products

CUSIP: 034522102

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 520.00

Most Recent Split Date: (:1)

Beta: 0.97

Market Capitalization: $9,240.40 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.95% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.35 |

| Current Fiscal Year EPS Consensus Estimate: $1.27 |

Payout Ratio: 0.34 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.05 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |