| Zacks Company Profile for Argan, Inc. (AGX : NYSE) |

|

|

| |

| • Company Description |

| Argan, Inc., headquartered in Rockville, MD, through its wholly owned Southern Maryland Cable, Inc. subsidiary, provides inside premise wiring services to the federal government and also provides underground and aerial construction services and splicing to major telecommunications and utilities customers.

Number of Employees: 1,595 |

|

|

| |

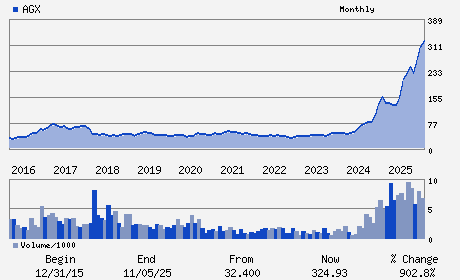

| • Price / Volume Information |

| Yesterday's Closing Price: $445.36 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 398,395 shares |

| Shares Outstanding: 13.87 (millions) |

| Market Capitalization: $6,178.66 (millions) |

| Beta: 0.57 |

| 52 Week High: $459.75 |

| 52 Week Low: $101.02 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

25.18% |

26.91% |

| 12 Week |

39.48% |

38.76% |

| Year To Date |

42.14% |

41.40% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

4075 WILSON BOULEVARD SUITE 440

-

ARLINGTON,VA 22203

USA |

ph: 301-315-0027

fax: 301-315-0064 |

ir@arganinc.com |

http://www.arganinc.com |

|

|

| |

| • General Corporate Information |

Officers

David H. Watson - President and Chief Executive Officer; Director

William F. Leimkuhler - Chairman of the Board of Directors

Joshua S. Baugher - Senior Vice President; Chief Financial Officer and

Rainer H. Bosselmann - Director

Cynthia A. Flanders - Director

|

|

Peer Information

Argan, Inc. (CSRLY)

Argan, Inc. (ARRD)

Argan, Inc. (CGMCQ)

Argan, Inc. (CMCJY)

Argan, Inc. (OMRP)

Argan, Inc. (ABLT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG&CONST-MISC

Sector: Construction

CUSIP: 04010E109

SIC: 1700

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/26/26

|

|

Share - Related Items

Shares Outstanding: 13.87

Most Recent Split Date: 10.00 (0.07:1)

Beta: 0.57

Market Capitalization: $6,178.66 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.45% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.22 |

Indicated Annual Dividend: $2.00 |

| Current Fiscal Year EPS Consensus Estimate: $10.18 |

Payout Ratio: 0.24 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: -0.15 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 01/22/2026 - $0.50 |

| Next EPS Report Date: 03/26/26 |

|

|

|

| |