| Zacks Company Profile for Adecco SA (AHEXY : OTC) |

|

|

| |

| • Company Description |

| Adecco Group offers a wide variety of services that connects colleagues with clients every day. The services offered fall into the broad categories of temporary staffing, permanent placement, outsourcing, consulting and outplacement. It also provides services in various business lines such as information technology, finance and legal, engineering and technical, medical and science, human capital solutions, sales, marketing and events. Adecco S.A. is headquartered in Glattbrugg, Switzerland.

Number of Employees: 35,000 |

|

|

| |

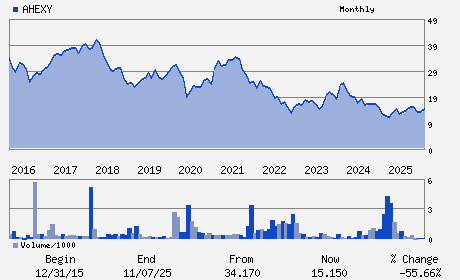

| • Price / Volume Information |

| Yesterday's Closing Price: $13.32 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 13,540 shares |

| Shares Outstanding: 334.87 (millions) |

| Market Capitalization: $4,459.15 (millions) |

| Beta: 1.04 |

| 52 Week High: $16.89 |

| 52 Week Low: $12.19 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-10.39% |

-9.16% |

| 12 Week |

1.45% |

0.93% |

| Year To Date |

-7.98% |

-8.46% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

Bellerivestrasse 30

-

Zurich,V8 8008

CHE |

ph: 41-44-878-8888

fax: - |

None |

http://www.adeccogroup.com |

|

|

| |

| • General Corporate Information |

Officers

Denis Machuel - Chief Executive Officer

Jean-Christophe Deslarzes - Chair of the Board

Coram Williams - Chief Financial Officer

Kathleen Taylor - Director

Rachel Duan - Director

|

|

Peer Information

Adecco SA (CGEMY)

Adecco SA (GLXG)

Adecco SA (SRT)

Adecco SA (CVG)

Adecco SA (HEW)

Adecco SA (BBSI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Outsourcing

Sector: Business Services

CUSIP: 006754204

SIC: 7363

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 334.87

Most Recent Split Date: (:1)

Beta: 1.04

Market Capitalization: $4,459.15 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.41% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.27 |

Indicated Annual Dividend: $0.32 |

| Current Fiscal Year EPS Consensus Estimate: $1.54 |

Payout Ratio: 0.24 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: -0.16 |

| Estmated Long-Term EPS Growth Rate: 8.30% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |