| Zacks Company Profile for Asahi Kasei Corp. (AHKSY : OTC) |

|

|

| |

| • Company Description |

| ASAHI KASEI CORPORATION, provides innovative solutions based in chemistry and materials science to a diverse range of markets including fibers, chemicals, consumer products, housing, construction, electronics, and health care. On October 1, 2003, all core operations were transferred to wholly owned constituent corporations as autonomous operating business units. Asahi Kasei Corporation, as the parent company, functions as a holding company for group operations. An Independent Businesses Group not included in the constituent corporations provides group services.

Number of Employees: |

|

|

| |

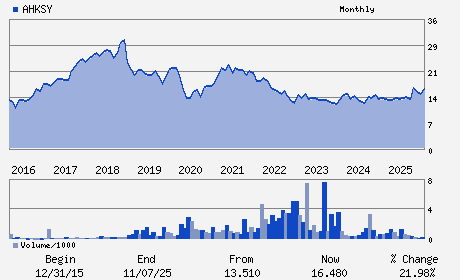

| • Price / Volume Information |

| Yesterday's Closing Price: $23.77 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 25,690 shares |

| Shares Outstanding: 696.97 (millions) |

| Market Capitalization: $16,566.88 (millions) |

| Beta: 0.41 |

| 52 Week High: $24.12 |

| 52 Week Low: $12.12 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

22.65% |

24.34% |

| 12 Week |

36.02% |

35.33% |

| Year To Date |

34.35% |

33.64% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1-1-2 YurakuchoChiyoda-ku

-

Tokyo,M0 100-0006

JPN |

ph: 813-6699-3008

fax: 813-6699-3187 |

None |

http://www.asahi-kasei.com |

|

|

| |

| • General Corporate Information |

Officers

Koshiro Kudo - President and Presidential Executive Officer

Hideki Kobori - Chairman & Director

Kazushi Kuse - Vice-Presidential Executive Officer

Toshiyasu Horie - Representative Director

Hiroki Ideguchi - Director

|

|

Peer Information

Asahi Kasei Corp. (ENFY)

Asahi Kasei Corp. (EMLIF)

Asahi Kasei Corp. (GPLB)

Asahi Kasei Corp. (BCPUQ)

Asahi Kasei Corp. (CYT.)

Asahi Kasei Corp. (SOA)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: CHEM-DIVERSIFD

Sector: Basic Materials

CUSIP: 043400100

SIC: 2800

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/08/26

|

|

Share - Related Items

Shares Outstanding: 696.97

Most Recent Split Date: 10.00 (5.00:1)

Beta: 0.41

Market Capitalization: $16,566.88 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.30% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.31 |

| Current Fiscal Year EPS Consensus Estimate: $1.27 |

Payout Ratio: 0.19 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.09 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/08/26 |

|

|

|

| |