| Zacks Company Profile for Airgain, Inc. (AIRG : NSDQ) |

|

|

| |

| • Company Description |

| Airgain, Inc. is a provider of embedded antenna technologies. It offers antennas for the devices which are deployed in carrier, enterprise and residential wireless networks and systems, including set top boxes, access points, routers, gateways, media adapters and digital televisions. The company also offers residential wireless local area network or wireless fidelity to carriers, original equipment manufacturers, original design manufacturers and system designers. Airgain, Inc. is based in San Diego, United States.

Number of Employees: 106 |

|

|

| |

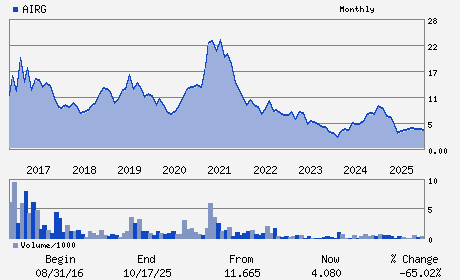

| • Price / Volume Information |

| Yesterday's Closing Price: $4.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 61,498 shares |

| Shares Outstanding: 12.22 (millions) |

| Market Capitalization: $51.34 (millions) |

| Beta: 0.93 |

| 52 Week High: $5.91 |

| 52 Week Low: $3.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-0.47% |

0.40% |

| 12 Week |

6.33% |

6.20% |

| Year To Date |

3.45% |

2.95% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

3611 VALLEY CENTRE DRIVE SUITE 150

-

SAN DIEGO,CA 92130

USA |

ph: 760-579-0200

fax: 760-280-1729 |

airg@gateway-grp.com |

http://www.airgain.com |

|

|

| |

| • General Corporate Information |

Officers

Jacob Suen - President and Chief Executive Officer

James K. Sims - Chairman

Michael Elbaz - Chief Financial Officer and Secretary

Kiva A. Allgood - Director

Tzau-Jin Chung - Director

|

|

Peer Information

Airgain, Inc. (ATGN)

Airgain, Inc. (AUDC)

Airgain, Inc. (OIVO)

Airgain, Inc. (ETCIA)

Airgain, Inc. (DIGL)

Airgain, Inc. (INVT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Communications Components

Sector: Computer and Technology

CUSIP: 00938A104

SIC: 3663

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 12.22

Most Recent Split Date: (:1)

Beta: 0.93

Market Capitalization: $51.34 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.12 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.21 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |