| Zacks Company Profile for Applied Industrial Technologies, Inc. (AIT : NYSE) |

|

|

| |

| • Company Description |

| Applied Industrial Technologies, Inc. is a distributor of value-added industrial products including engineered fluid power components, bearings, specialty flow control solutions, power transmission products and miscellaneous industrial supplies. These products are mainly sold to original equipment manufacturers and maintenance, repair, and operations customers in Australia, N. America, Singapore and New Zealand. It reports revenues under 2 business segments. Service Center-Based Distribution segment offers different types of industrial products majorly through service centers in New Zealand, Australia and N. America and also provides services in the oil and gas industry as well as includes operations of fabricated rubber shops and rubber service field crews. Fluid Power & Flow Control segment includes specialized regional companies that offer fluid power components, assembling and designing of fluid power systems, and provides equipment repairing services.

Number of Employees: 6,800 |

|

|

| |

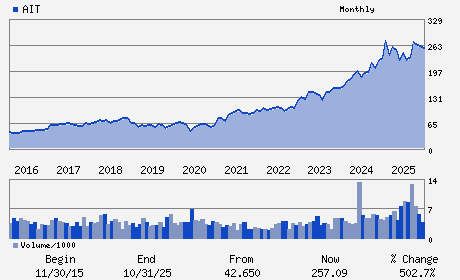

| • Price / Volume Information |

| Yesterday's Closing Price: $283.54 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 324,930 shares |

| Shares Outstanding: 37.30 (millions) |

| Market Capitalization: $10,576.73 (millions) |

| Beta: 0.81 |

| 52 Week High: $296.70 |

| 52 Week Low: $199.96 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.01% |

6.45% |

| 12 Week |

10.22% |

9.66% |

| Year To Date |

10.43% |

9.85% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Neil A. Schrimsher - Chief Executive Officer and President

Peter C. Wallace - Chairman

David K. Wells - Vice President; Chief Financial Officer and Treasu

Richard M. Wagner - Chief Accounting Officer; Controller and Principal

Madhuri A. Andrews - Director

|

|

Peer Information

Applied Industrial Technologies, Inc. (B.)

Applied Industrial Technologies, Inc. (DXPE)

Applied Industrial Technologies, Inc. (AIT)

Applied Industrial Technologies, Inc. (GDI.)

Applied Industrial Technologies, Inc. (CTITQ)

Applied Industrial Technologies, Inc. (EBCOY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-GENL INDL

Sector: Industrial Products

CUSIP: 03820C105

SIC: 5080

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 37.30

Most Recent Split Date: 6.00 (1.50:1)

Beta: 0.81

Market Capitalization: $10,576.73 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.72% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.63 |

Indicated Annual Dividend: $2.04 |

| Current Fiscal Year EPS Consensus Estimate: $10.65 |

Payout Ratio: 0.18 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: 9.81% |

Last Dividend Paid: 02/13/2026 - $0.51 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |