| Zacks Company Profile for Alamo Group, Inc. (ALG : NYSE) |

|

|

| |

| • Company Description |

| Alamo Group is a leader in the design, manufacture, distribution and service of high quality equipment for infrastructure maintenance, agriculture and other applications. Their products include truck and tractor mounted mowing and other vegetation maintenance equipment, street sweepers, snow removal equipment, excavators, vacuum trucks, other industrial equipment, agricultural implements and related after-market parts and services.

Number of Employees: 3,750 |

|

|

| |

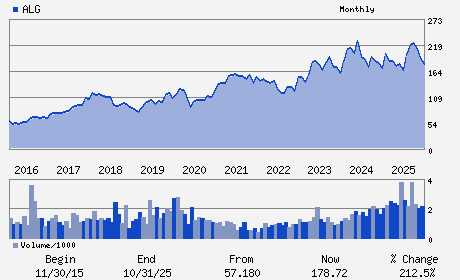

| • Price / Volume Information |

| Yesterday's Closing Price: $213.53 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 108,980 shares |

| Shares Outstanding: 12.11 (millions) |

| Market Capitalization: $2,587.01 (millions) |

| Beta: 1.10 |

| 52 Week High: $233.29 |

| 52 Week Low: $156.30 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

9.33% |

10.28% |

| 12 Week |

29.52% |

29.36% |

| Year To Date |

27.20% |

26.58% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1627 EAST WALNUT

-

SEGUIN,TX 78155

USA |

ph: 830-379-1480

fax: 830-372-9683 |

None |

http://www.alamo-group.com |

|

|

| |

| • General Corporate Information |

Officers

Jeffery A. Leonard - President & Chief Executive Officer

Richard W. Parod - Independent Board Chair & Director

Agnieszka K. Kamps - Executive Vice President & Chief Financial Officer

Robert P. Bauer - Director

Eric P. Etchart - Director

|

|

Peer Information

Alamo Group, Inc. (BGGSQ)

Alamo Group, Inc. (INQD)

Alamo Group, Inc. (T.FTT)

Alamo Group, Inc. (ALG)

Alamo Group, Inc. (CTBC2)

Alamo Group, Inc. (LNN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-FARM

Sector: Industrial Products

CUSIP: 011311107

SIC: 3523

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/02/26

|

|

Share - Related Items

Shares Outstanding: 12.11

Most Recent Split Date: (:1)

Beta: 1.10

Market Capitalization: $2,587.01 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.64% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.39 |

Indicated Annual Dividend: $1.36 |

| Current Fiscal Year EPS Consensus Estimate: $11.20 |

Payout Ratio: 0.12 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: 16.00% |

Last Dividend Paid: 01/16/2026 - $0.34 |

| Next EPS Report Date: 03/02/26 |

|

|

|

| |