| Zacks Company Profile for AMETEK, Inc. (AME : NYSE) |

|

|

| |

| • Company Description |

| AMETEK is one of the leading manufacturers of electronic appliances and electromechanical devices. The company operates sales and service stations in North America, Europe, Asia and South America. AMETEK sells its products globally through two operating groups, the Electronic Instruments Group and the Electromechanical Group. The Electronic Instruments Group specializes in manufacturing instruments employed for monitoring, examining, calibration and display purposes in the aerospace, power and industrial instrumentation markets. The segment is one of the leaders in many of the markets it serves, including airframe and aircraft engine sensors; process and analytical instruments; electric power generation, distribution and transmission instruments; and heavy-vehicle instrument panels. The Electromechanical Group produces engineered electrical connectors and electronics packaging for electronic applications in aerospace, defense, medical and industrial markets.

Number of Employees: 22,500 |

|

|

| |

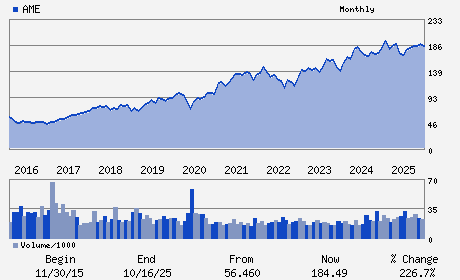

| • Price / Volume Information |

| Yesterday's Closing Price: $239.22 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,361,410 shares |

| Shares Outstanding: 228.98 (millions) |

| Market Capitalization: $54,775.93 (millions) |

| Beta: 1.02 |

| 52 Week High: $239.24 |

| 52 Week Low: $145.02 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

6.80% |

7.74% |

| 12 Week |

19.73% |

19.58% |

| Year To Date |

16.52% |

15.95% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

David A. Zapico - Chairman and Chief Executive Officer

Dalip M. Puri - Executive Vice President and Chief Financial Offic

Robert J. Amodei - Senior Vice President

Thomas A. Amato - Director

Tod E. Carpenter - Director

|

|

Peer Information

AMETEK, Inc. (AHIX)

AMETEK, Inc. (ITRI)

AMETEK, Inc. (AME)

AMETEK, Inc. (FTV)

AMETEK, Inc. (NATI)

AMETEK, Inc. (PRTKQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC TEST EQUIPTMENT

Sector: Computer and Technology

CUSIP: 031100100

SIC: 3823

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 228.98

Most Recent Split Date: 7.00 (1.50:1)

Beta: 1.02

Market Capitalization: $54,775.93 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.52% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.90 |

Indicated Annual Dividend: $1.24 |

| Current Fiscal Year EPS Consensus Estimate: $8.04 |

Payout Ratio: 0.17 |

| Number of Estimates in the Fiscal Year Consensus: 11.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 8.70% |

Last Dividend Paid: 12/05/2025 - $0.31 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |