| Zacks Company Profile for American Homes 4 Rent (AMH : NYSE) |

|

|

| |

| • Company Description |

| American Homes 4 Rent is an internally managed real estate investment trust. It is focused on acquiring, renovating, leasing, and operating single-family homes as rental properties. It rents residential properties primarily in Arizona, California, Florida, Georgia, and Nevada. American Homes 4 Rent is based in Malibu, California.

Number of Employees: 1,598 |

|

|

| |

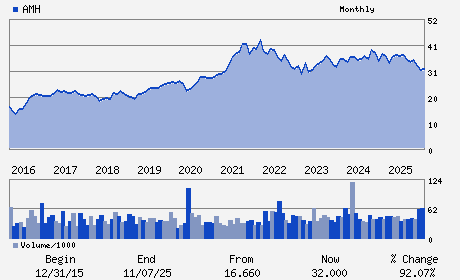

| • Price / Volume Information |

| Yesterday's Closing Price: $30.00 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 5,097,635 shares |

| Shares Outstanding: 363.78 (millions) |

| Market Capitalization: $10,913.29 (millions) |

| Beta: 0.80 |

| 52 Week High: $39.49 |

| 52 Week Low: $28.84 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-4.21% |

-3.38% |

| 12 Week |

-2.69% |

-2.81% |

| Year To Date |

-6.54% |

-7.00% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

280 Pilot Road

-

Las Vegas,NV 89119

USA |

ph: 805-413-5300

fax: - |

investors@amh.com |

http://www.amh.com |

|

|

| |

| • General Corporate Information |

Officers

Bryan Smith - Chief Executive Officer and Trustee

Chris Lau - Chief Financial Officer and Senior Executive Vice

Brian Reitz - Executive Vice President; Chief Accounting Officer

Douglas Benham - Trustee

Jack Corrigan - Trustee

|

|

Peer Information

American Homes 4 Rent (CPT)

American Homes 4 Rent (BHM)

American Homes 4 Rent (EQR)

American Homes 4 Rent (SAFE)

American Homes 4 Rent (AEC)

American Homes 4 Rent (VRE)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REIT-EQTY TRUST - RESID

Sector: Finance

CUSIP: 02665T306

SIC: 6798

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 363.78

Most Recent Split Date: (:1)

Beta: 0.80

Market Capitalization: $10,913.29 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.48 |

Indicated Annual Dividend: $1.20 |

| Current Fiscal Year EPS Consensus Estimate: $1.94 |

Payout Ratio: 0.64 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: 0.12 |

| Estmated Long-Term EPS Growth Rate: 3.61% |

Last Dividend Paid: 12/15/2025 - $0.30 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |