| Zacks Company Profile for Alpha and Omega Semiconductor Limited (AOSL : NSDQ) |

|

|

| |

| • Company Description |

| Alpha and Omega Semiconductor Limited is engaged in designing, developing and supplying a broad range of power semiconductors globally, including a portfolio of Power MOSFET and Power IC products. The Company seeks to differentiate itself by integrating its expertise in device physics, process technology, design and advanced packaging to optimize product performance and cost. Its portfolio of products targets high-volume end-market applications, such as notebooks, netbooks, flat panel displays, mobile phone battery packs, set-top boxes, portable media players and power supplies. The products are incorporated into devices by original equipment manufacturers, or OEMs. The Company utilizes third-party foundries for all of its wafer fabrication and it deploys and implements its proprietary MOSFET processes at these third party foundries. The Company relies upon its in-house capacity and an associated provider for most of its packaging and testing requirements.

Number of Employees: 2,428 |

|

|

| |

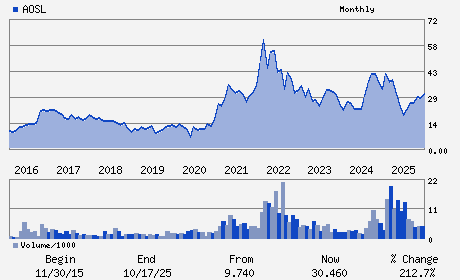

| • Price / Volume Information |

| Yesterday's Closing Price: $21.01 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 397,150 shares |

| Shares Outstanding: 29.76 (millions) |

| Market Capitalization: $625.28 (millions) |

| Beta: 1.99 |

| 52 Week High: $33.01 |

| 52 Week Low: $15.90 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-4.93% |

-4.10% |

| 12 Week |

-1.08% |

-1.20% |

| Year To Date |

6.06% |

5.54% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Stephen C. Chang - Chief Executive Officer and Director

Mike F. Chang - Chairman of the Board and Executive Vice President

Yifan Liang - Chief Financial Officer and Corporate Secretary

Lucas S. Chang - Director

Claudia Chen - Director

|

|

Peer Information

Alpha and Omega Semiconductor Limited (CPCL.)

Alpha and Omega Semiconductor Limited (HIFN)

Alpha and Omega Semiconductor Limited (SEM.1)

Alpha and Omega Semiconductor Limited (DION)

Alpha and Omega Semiconductor Limited (AMKR)

Alpha and Omega Semiconductor Limited (CNXT.)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC COMP-SEMIC

Sector: Computer and Technology

CUSIP: G6331P104

SIC: 3674

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 29.76

Most Recent Split Date: (:1)

Beta: 1.99

Market Capitalization: $625.28 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.58 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-1.65 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |