| Zacks Company Profile for APA Corporation (APA : NSDQ) |

|

|

| |

| • Company Description |

| APA Corp. is one of the world's leading independent energy companies engaged in the exploration, development and production of natural gas, crude oil and natural gas liquids. Geographically, the company's operations are in the U.S., Egypt and in the North Sea of the U.K. APA also holds acreage in offshore Suriname (S. America) & other international locations. In the U.S., the upstream player mainly operates in the prolific Permian Basin. One of the largest oil producers in Permian, APA operates oil and gas wells in the region, with exposure to Midland Basin, Delaware Basin, Central Basin Platform/ Northwestern Shelf. APA's major find is Alpine High located in the southern portion of the Delaware Basin will likely be the key volume growth driver in the years to come. APA is also involved in the midstream business through its minority stake in Permian-focused Altus Midstream Company.

Number of Employees: 1,791 |

|

|

| |

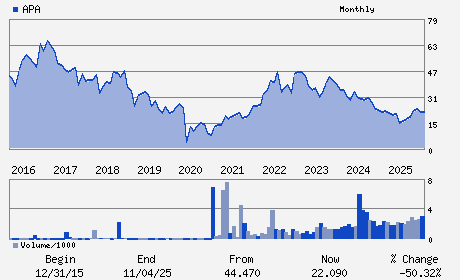

| • Price / Volume Information |

| Yesterday's Closing Price: $30.37 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 6,733,722 shares |

| Shares Outstanding: 354.67 (millions) |

| Market Capitalization: $10,771.31 (millions) |

| Beta: 0.67 |

| 52 Week High: $32.75 |

| 52 Week Low: $13.58 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

14.99% |

16.00% |

| 12 Week |

12.07% |

11.93% |

| Year To Date |

24.16% |

23.56% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

2000 W SAM HOUSTON PKWY S SUITE 200

-

HOUSTON,TX 77042

USA |

ph: 713-296-6000

fax: 713-296-6455 |

ir@apachecorp.com |

https://apacorp.com |

|

|

| |

| • General Corporate Information |

Officers

John J. Christmann - Chief Executive Officer and Director

H. Lamar McKay - Non-Executive Chair of the Board and Director

Ben C. Rodgers - Executive Vice President and Chief Financial Offic

Robert P. Rayphole - Vice President; Chief Accounting Officer

Annell R. Bay - Director

|

|

Peer Information

APA Corporation (AEGG)

APA Corporation (CHAR)

APA Corporation (CECX.)

APA Corporation (DLOV)

APA Corporation (WACC)

APA Corporation (DVN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: OIL-US EXP&PROD

Sector: Oils/Energy

CUSIP: 03743Q108

SIC: 1311

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 354.67

Most Recent Split Date: 1.00 (2.00:1)

Beta: 0.67

Market Capitalization: $10,771.31 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.29% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.56 |

Indicated Annual Dividend: $1.00 |

| Current Fiscal Year EPS Consensus Estimate: $2.08 |

Payout Ratio: 0.27 |

| Number of Estimates in the Fiscal Year Consensus: 11.00 |

Change In Payout Ratio: 0.09 |

| Estmated Long-Term EPS Growth Rate: 1.05% |

Last Dividend Paid: 01/22/2026 - $0.25 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |