| Zacks Company Profile for Arcadis NV (ARCAY : OTC) |

|

|

| |

| • Company Description |

| ARCADIS NV is an international company that provides consultancy, planning, architectural design, engineering and management services for infrastructure, environment and buildings. ARCADIS focuses its services on three business lines, which include infrastructure, environment and buildings. In infrastructure ARCADIS provides consultancy, design and construction management for rural and urban infrastructure. The environmental activities range from soil and groundwater contamination investigation and remediation to consultancy on corporate energy and waste management issues, environmental policies for companies and governments, environmental impact assessments and carbon footprint reduction. ARCADIS buildings activities comprises planning, design, development and project and cost management of buildings, as well as the facility management related to these buildings after completion.

Number of Employees: 35,246 |

|

|

| |

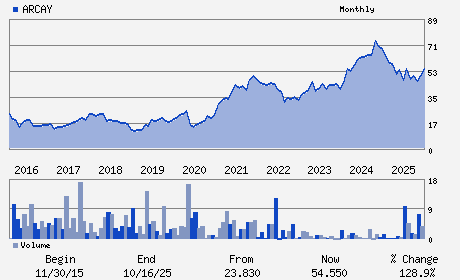

| • Price / Volume Information |

| Yesterday's Closing Price: $43.97 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 128 shares |

| Shares Outstanding: 90.44 (millions) |

| Market Capitalization: $3,976.74 (millions) |

| Beta: 0.49 |

| 52 Week High: $60.83 |

| 52 Week Low: $28.86 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-12.06% |

-11.29% |

| 12 Week |

-7.90% |

-8.01% |

| Year To Date |

7.24% |

6.72% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Alan Brookes - Chief Executive Officer and Chairman

Virginie J.H. Duperat-Vergne - Chief Financial Officer

Heather L. Polinsky - Global President of Resilience and Director

Nick Henderson - Director

Jurgen Pullens - Director

|

|

Peer Information

Arcadis NV (TURN)

Arcadis NV (FWLT)

Arcadis NV (CTAK)

Arcadis NV (AVNA)

Arcadis NV (NLX.)

Arcadis NV (T.AGR)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ENGINRG/R&D SVS

Sector: Construction

CUSIP: 03923E107

SIC: 8711

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 90.44

Most Recent Split Date: 5.00 (3.00:1)

Beta: 0.49

Market Capitalization: $3,976.74 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.19% |

| Current Fiscal Quarter EPS Consensus Estimate: $ |

Indicated Annual Dividend: $0.96 |

| Current Fiscal Year EPS Consensus Estimate: $3.88 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |