| Zacks Company Profile for Alexandria Real Estate Equities, Inc. (ARE : NYSE) |

|

|

| |

| • Company Description |

| Alexandria Real Estate Equities, Inc. is a urban office real estate investment trust (REIT) with particular focus on collaborative life science, agtech and technology campuses. The company believe in the utmost professionalism, humility, and teamwork. The companies tenants include multinational pharmaceutical companies; public and private biotechnology companies; life science product, service, and medical device companies; digital health, technology, and agtech companies; academic and medical research institutions; U.S. government research agencies; non-profit organizations; and venture capital firms. Alexandria also provides strategic capital to transformative life science, agtech, and technology campuses through our venture capital platform. The company believe these advantages result in higher occupancy levels, longer lease terms, higher rental income, higher returns, and greater long-term asset value.

Number of Employees: 552 |

|

|

| |

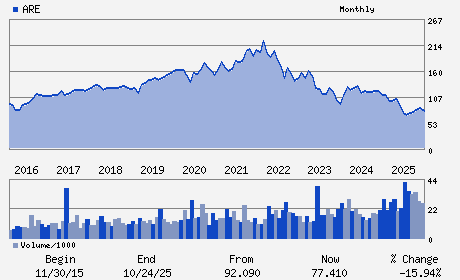

| • Price / Volume Information |

| Yesterday's Closing Price: $59.69 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,228,885 shares |

| Shares Outstanding: 172.82 (millions) |

| Market Capitalization: $10,315.93 (millions) |

| Beta: 1.31 |

| 52 Week High: $105.14 |

| 52 Week Low: $44.10 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

22.82% |

23.07% |

| 12 Week |

2.52% |

1.41% |

| Year To Date |

21.97% |

20.73% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Peter M. Moglia - Chief Executive Officer and Chief Investment Offic

Joel S. Marcus - Executive Chairman

Marc E. Binda - Chief Financial Officer and Treasurer

Andres R. Gavinet - Chief Accounting Officer

Steven R. Hash - Director

|

|

Peer Information

Alexandria Real Estate Equities, Inc. (ARE)

Alexandria Real Estate Equities, Inc. (CUZ)

Alexandria Real Estate Equities, Inc. (FUR)

Alexandria Real Estate Equities, Inc. (NNN)

Alexandria Real Estate Equities, Inc. (FCH)

Alexandria Real Estate Equities, Inc. (CTO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REIT-EQTY TRUST -OTHER

Sector: Finance

CUSIP: 015271109

SIC: 6798

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 01/26/26

|

|

Share - Related Items

Shares Outstanding: 172.82

Most Recent Split Date: (:1)

Beta: 1.31

Market Capitalization: $10,315.93 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.82% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.80 |

Indicated Annual Dividend: $2.88 |

| Current Fiscal Year EPS Consensus Estimate: $6.42 |

Payout Ratio: 0.57 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 1.29% |

Last Dividend Paid: 12/31/2025 - $0.72 |

| Next EPS Report Date: 01/26/26 |

|

|

|

| |