| Zacks Company Profile for Array Technologies, Inc. (ARRY : NSDQ) |

|

|

| |

| • Company Description |

| Array Technologies Inc. is a provider of solar tracking technology which construct, develop and operate solar PV sites. Array Technologies Inc. is based in ALBUQUERQUE, N.M.

Number of Employees: 1,200 |

|

|

| |

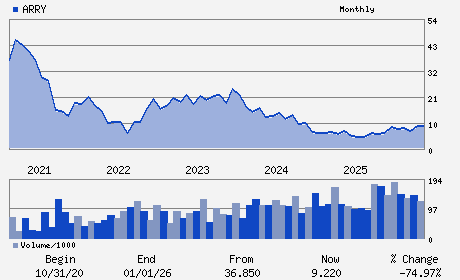

| • Price / Volume Information |

| Yesterday's Closing Price: $7.58 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 6,838,251 shares |

| Shares Outstanding: 152.85 (millions) |

| Market Capitalization: $1,158.59 (millions) |

| Beta: 1.76 |

| 52 Week High: $12.23 |

| 52 Week Low: $3.76 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-33.07% |

-32.48% |

| 12 Week |

-4.29% |

-4.41% |

| Year To Date |

-17.79% |

-18.19% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Kevin Hostetler - Chief Executive Officer and Director

Brad Forth - Chairman of the Board of Directors

H. Keith Jennings - Chief Financial Officer

James Zhu - Chief Accounting Officer

Troy Alstead - Director

|

|

Peer Information

Array Technologies, Inc. (ENERQ)

Array Technologies, Inc. (NXT)

Array Technologies, Inc. (PSWW)

Array Technologies, Inc. (DSTI)

Array Technologies, Inc. (ESLRQ)

Array Technologies, Inc. (EBODF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Solar

Sector: Oils/Energy

CUSIP: 04271T100

SIC: 3990

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 152.85

Most Recent Split Date: (:1)

Beta: 1.76

Market Capitalization: $1,158.59 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.21 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.78 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 18.94% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |