| Zacks Company Profile for Arrow Electronics, Inc. (ARW : NYSE) |

|

|

| |

| • Company Description |

| Arrow Electronics Inc. is one of the world's largest distributors of electronic components and enterprise computing products. Arrow provides one of the broadest product ranges in the electronic components and enterprise computing solutions distribution industries. It provides a wide range of value-added services to help customers reduce their marketing time, lower the total cost of ownership, introduce innovative products through demand creation opportunities and enhance their overall competitiveness. The company customer base comprises original equipment manufacturers, contract manufactures and commercial customers across countries, value-added resellers and other commercial users. Arrow's offerings can be divided into two categories: Global Components and Global Enterprise Computing Solutions. These units deal in semiconductor products and related services and also products like servers, workstations, storage products, microcomputer boards and systems, design systems, desktop computer systems, etc.

Number of Employees: 22,230 |

|

|

| |

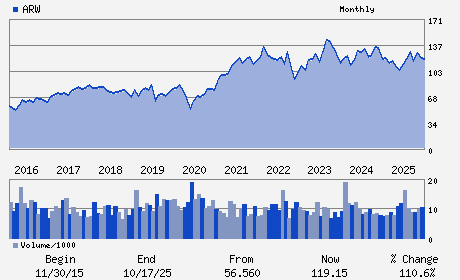

| • Price / Volume Information |

| Yesterday's Closing Price: $152.16 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 766,728 shares |

| Shares Outstanding: 51.09 (millions) |

| Market Capitalization: $7,773.27 (millions) |

| Beta: 1.01 |

| 52 Week High: $162.61 |

| 52 Week Low: $86.50 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

14.85% |

15.85% |

| 12 Week |

35.28% |

35.11% |

| Year To Date |

38.10% |

37.43% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

9151 East Panorama Circle

-

Centennial,CO 80112

USA |

ph: 303-824-4000

fax: 631-847-2222 |

investor@arrow.com |

http://www.arrow.com |

|

|

| |

| • General Corporate Information |

Officers

William F. Austen - President and Chief Executive Officer

Steven H. Gunby - Chairman

Rajesh K. Agrawal - Senior Vice President and Chief Financial Officer

Brandon Brewbaker - Vice President; Corporate FP&A; Chief Accounting O

Lawrence (Liren) Chen - Director

|

|

Peer Information

Arrow Electronics, Inc. (RELL)

Arrow Electronics, Inc. (AXE)

Arrow Electronics, Inc. (NUHC)

Arrow Electronics, Inc. (ARW)

Arrow Electronics, Inc. (WCC)

Arrow Electronics, Inc. (NVNXF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: ELEC PARTS DIST

Sector: Computer and Technology

CUSIP: 042735100

SIC: 5065

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 51.09

Most Recent Split Date: 10.00 (2.00:1)

Beta: 1.01

Market Capitalization: $7,773.27 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.83 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $13.24 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 15.19% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |