| Zacks Company Profile for Academy Sports and Outdoors, Inc. (ASO : NSDQ) |

|

|

| |

| • Company Description |

| Academy Sports and Outdoors Inc. provides sporting goods and outdoor recreation retailers principally in the United States. The company's product assortment focuses on outdoor, apparel, footwear and sports & recreation. Academy Sports and Outdoors Inc. is based in KATY, Texas.

Number of Employees: 22,000 |

|

|

| |

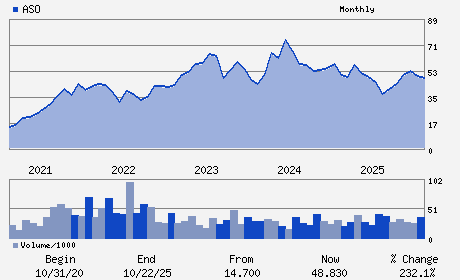

| • Price / Volume Information |

| Yesterday's Closing Price: $60.13 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,275,890 shares |

| Shares Outstanding: 66.68 (millions) |

| Market Capitalization: $4,009.55 (millions) |

| Beta: 1.23 |

| 52 Week High: $62.45 |

| 52 Week Low: $33.34 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

9.31% |

10.26% |

| 12 Week |

19.71% |

19.56% |

| Year To Date |

20.36% |

19.77% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Steven Lawrence - Chief Executive Officer and Director

Ken C. Hicks - Chairman of the Board

Samuel J. Johnson - President

Earl Carlton Ford, IV - Executive Vice President and Chief Financial Offic

Wendy A. Beck - Director

|

|

Peer Information

Academy Sports and Outdoors, Inc. (BAJAY)

Academy Sports and Outdoors, Inc. (ESCA)

Academy Sports and Outdoors, Inc. (GOYL)

Academy Sports and Outdoors, Inc. (FTSP)

Academy Sports and Outdoors, Inc. (KTO)

Academy Sports and Outdoors, Inc. (BOLL)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: LEISURE&REC PRD

Sector: Consumer Discretionary

CUSIP: 00402L107

SIC: 5940

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/19/26

|

|

Share - Related Items

Shares Outstanding: 66.68

Most Recent Split Date: (:1)

Beta: 1.23

Market Capitalization: $4,009.55 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.86% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.83 |

Indicated Annual Dividend: $0.52 |

| Current Fiscal Year EPS Consensus Estimate: $6.14 |

Payout Ratio: 0.10 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: 0.04 |

| Estmated Long-Term EPS Growth Rate: 9.32% |

Last Dividend Paid: 12/18/2025 - $0.13 |

| Next EPS Report Date: 03/19/26 |

|

|

|

| |