| Zacks Company Profile for Aspen Aerogels, Inc. (ASPN : NYSE) |

|

|

| |

| • Company Description |

| Aspen Aerogels, Inc. is an energy technology company that designs, develops and manufactures aerogel insulation used primarily in large-scale energy infrastructure facilities. The Company offers insulation for high temperature steam pipes, vessels, and equipment. Aspen serves petrochemical, refinery, industrial, and power generation sectors. It manufactures Cryogel (R), Pyrogel (R) and Spaceloft (R) products. Aspen Aerogels, Inc. is headquartered in Northborough, Massachusetts.

Number of Employees: 554 |

|

|

| |

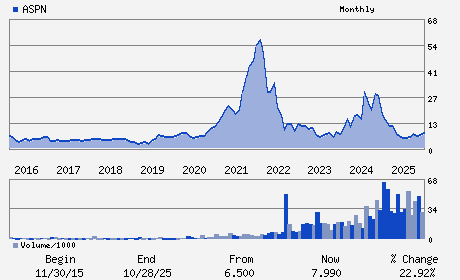

| • Price / Volume Information |

| Yesterday's Closing Price: $3.12 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,689,778 shares |

| Shares Outstanding: 82.65 (millions) |

| Market Capitalization: $257.86 (millions) |

| Beta: 2.99 |

| 52 Week High: $9.78 |

| 52 Week Low: $2.31 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-7.42% |

-6.61% |

| 12 Week |

-11.86% |

-11.97% |

| Year To Date |

10.25% |

9.71% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Donald R. Young - President; Chief Executive Office

William P. Noglows - Chairperson

Ricardo C. Rodriguez - Chief Financial Officer and Treasurer

Santhosh P. Daniel - Chief Accounting Officer

Rebecca B. Blalock - Director

|

|

Peer Information

Aspen Aerogels, Inc. (CSRLY)

Aspen Aerogels, Inc. (ARRD)

Aspen Aerogels, Inc. (CGMCQ)

Aspen Aerogels, Inc. (CMCJY)

Aspen Aerogels, Inc. (OMRP)

Aspen Aerogels, Inc. (ABLT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG&CONST-MISC

Sector: Construction

CUSIP: 04523Y105

SIC: 5030

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 82.65

Most Recent Split Date: (:1)

Beta: 2.99

Market Capitalization: $257.86 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.27 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $-0.76 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |