| Zacks Company Profile for Amtech Systems, Inc. (ASYS : NSDQ) |

|

|

| |

| • Company Description |

| AMTECH SYSTEMS, INC. is engaged in the manufacture of several items of capital equipment, one of which is patented, used by customers in the manufacture of semiconductors. Co. has recently obtained a U.S. patent on technology on which it expects to base a proposed new photo chemical vapor deposition (``CVD``) product for use in semiconductor manufacturing facilities. The Company has engaged the University of California, Santa Cruz, to conduct a study to determine the feasibility of such a product.

Number of Employees: 264 |

|

|

| |

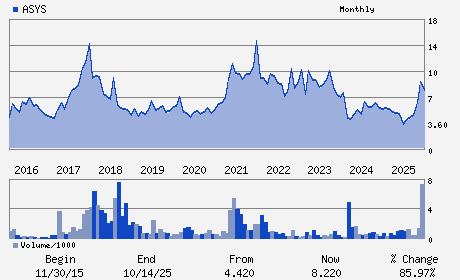

| • Price / Volume Information |

| Yesterday's Closing Price: $13.05 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 400,996 shares |

| Shares Outstanding: 14.41 (millions) |

| Market Capitalization: $188.01 (millions) |

| Beta: 1.67 |

| 52 Week High: $18.59 |

| 52 Week Low: $3.20 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-22.37% |

-21.69% |

| 12 Week |

46.47% |

46.28% |

| Year To Date |

3.98% |

3.48% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Robert C. Daigle - Chairman and Chief Executive Officer

Wade M. Jenke - Vice President and Chief Financial Officer

Robert M. Averick - Director

Michael Garnreiter - Director

Michael M. Ludwig - Director

|

|

Peer Information

Amtech Systems, Inc. (XCRA)

Amtech Systems, Inc. (INTC)

Amtech Systems, Inc. (NVDA)

Amtech Systems, Inc. (TXN)

Amtech Systems, Inc. (ISIL)

Amtech Systems, Inc. (SUOPY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: SEMI-GENERAL

Sector: Computer and Technology

CUSIP: 032332504

SIC: 3559

|

|

Fiscal Year

Fiscal Year End: September

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/11/26

|

|

Share - Related Items

Shares Outstanding: 14.41

Most Recent Split Date: 3.00 (0.50:1)

Beta: 1.67

Market Capitalization: $188.01 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.03 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.17 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/11/26 |

|

|

|

| |