| Zacks Company Profile for Atlas Copco AB (ATLKY : OTC) |

|

|

| |

| • Company Description |

| ATLAS COPCO is a world leading provider of industrial productivity solutions. The products and services range from compressed air and gas equipment, generators, construction and mining equipment, industrial tools and assembly systems, to related aftermarket and rental. In close cooperation with customers and business partners, and with 135 years of experience, Atlas Copco innovates for superior productivity. Headquartered in Stockholm, Sweden, the Group's global reach spans more than 160 markets.

Number of Employees: 54,206 |

|

|

| |

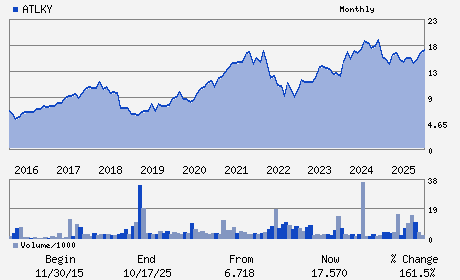

| • Price / Volume Information |

| Yesterday's Closing Price: $21.56 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 251,270 shares |

| Shares Outstanding: 4,875.06 (millions) |

| Market Capitalization: $105,106.19 (millions) |

| Beta: 1.41 |

| 52 Week High: $22.05 |

| 52 Week Low: $13.41 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.41% |

5.32% |

| 12 Week |

20.45% |

20.30% |

| Year To Date |

20.38% |

19.80% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Mats Rahmstrom - President and Chief Executive Officer

Hans Straberg - Chairman

Peter Kinnart - Chief Financial Officer

Eva Klasen - Senior Vice President

Cecilia Sandberg - Senior Vice President

|

|

Peer Information

Atlas Copco AB (B.)

Atlas Copco AB (DXPE)

Atlas Copco AB (AIT)

Atlas Copco AB (GDI.)

Atlas Copco AB (CTITQ)

Atlas Copco AB (EBCOY)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MACH-GENL INDL

Sector: Industrial Products

CUSIP: 049255706

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 4,875.06

Most Recent Split Date: 5.00 (4.00:1)

Beta: 1.41

Market Capitalization: $105,106.19 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.96% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.15 |

Indicated Annual Dividend: $0.21 |

| Current Fiscal Year EPS Consensus Estimate: $0.65 |

Payout Ratio: 0.38 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: -0.11 |

| Estmated Long-Term EPS Growth Rate: 11.20% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |