| Zacks Company Profile for Atara Biotherapeutics, Inc. (ATRA : NSDQ) |

|

|

| |

| • Company Description |

| Atara Biotherapeutics, Inc. is a clinical-stage biopharmaceutical company. It is focused on developing therapeutics for serious unmet medical needs, with an initial focus on muscle wasting conditions and oncology. The company's lead programs are focused on myostatin and activin, members of the TGF-beta family of proteins that have demonstrated the potential to have therapeutic benefit in a number of clinical indications. Its lead product candidate is PINTA 745, which is in a Phase II clinical trial for the treatment of protein-energy wasting in end-stage renal disease patients. Atara Biotherapeutics, Inc. is headquartered in Brisbane, California.

Number of Employees: 153 |

|

|

| |

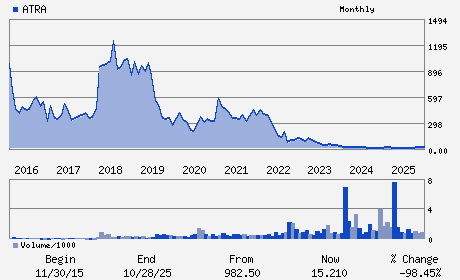

| • Price / Volume Information |

| Yesterday's Closing Price: $5.42 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 129,604 shares |

| Shares Outstanding: 7.21 (millions) |

| Market Capitalization: $39.08 (millions) |

| Beta: -0.44 |

| 52 Week High: $19.15 |

| 52 Week Low: $3.92 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

4.23% |

5.14% |

| 12 Week |

-62.18% |

-62.22% |

| Year To Date |

-70.04% |

-70.18% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

AnhCo Thieu Nguyen - President; Chief Executive Officer and Director

Pascal Touchon - Chairman and Director

Eric Hyllengren - Chief Financial Officer and Chief Operating Office

Carol G. Gallagher - Director

Matthew K. Fust - Director

|

|

Peer Information

Atara Biotherapeutics, Inc. (CORR.)

Atara Biotherapeutics, Inc. (RSPI)

Atara Biotherapeutics, Inc. (CGXP)

Atara Biotherapeutics, Inc. (BGEN)

Atara Biotherapeutics, Inc. (GTBP)

Atara Biotherapeutics, Inc. (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 046513206

SIC: 2836

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 03/06/26

|

|

Share - Related Items

Shares Outstanding: 7.21

Most Recent Split Date: 6.00 (0.04:1)

Beta: -0.44

Market Capitalization: $39.08 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.46 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.54 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 2.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/06/26 |

|

|

|

| |