| Zacks Company Profile for AvalonBay Communities, Inc. (AVB : NYSE) |

|

|

| |

| • Company Description |

| AvalonBay Communities, Inc. is a real estate investment trust primarily focusing on developing, redeveloping, acquisition, ownership and operations of multi-family apartment communities for higher-income clients in high barrier-to-entry regions of the United States, which generally command the highest rents in the markets. These markets include New England, the New York/New Jersey metro area, Mid-Atlantic, Pacific Northwest, and Northern and Southern California. The company is also tracking opportunities in the newly expanded markets of Raleigh-Durham and Charlotte, NC; Southeast Florida; Dallas and Austin, TX, and Denver, CO. The company focuses on metropolitan areas historically experiencing rising employment in high-wage sectors of the economy, along with high home ownership costs and a vibrant quality of life.

Number of Employees: 2,988 |

|

|

| |

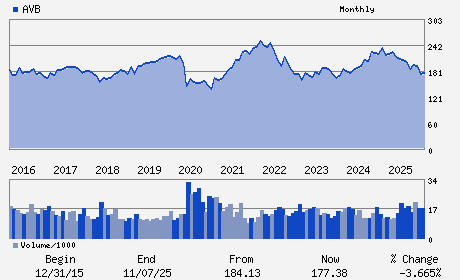

| • Price / Volume Information |

| Yesterday's Closing Price: $177.23 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,139,949 shares |

| Shares Outstanding: 141.60 (millions) |

| Market Capitalization: $25,094.87 (millions) |

| Beta: 0.75 |

| 52 Week High: $230.21 |

| 52 Week Low: $166.73 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-0.25% |

0.62% |

| 12 Week |

-0.44% |

-0.57% |

| Year To Date |

-2.25% |

-2.72% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Benjamin W. Schall - Chief Executive Officer and President

Timothy J. Naughton - Chairman of the Board of Directors

Kevin P. O'Shea - Chief Financial Officer

Sean T. Willson - Vice President - Corporate Controller

Glyn F. Aeppel - Director

|

|

Peer Information

AvalonBay Communities, Inc. (CPT)

AvalonBay Communities, Inc. (BHM)

AvalonBay Communities, Inc. (EQR)

AvalonBay Communities, Inc. (SAFE)

AvalonBay Communities, Inc. (AEC)

AvalonBay Communities, Inc. (VRE)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: REIT-EQTY TRUST - RESID

Sector: Finance

CUSIP: 053484101

SIC: 6798

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 09/01/25

Next Expected EPS Date: 04/29/26

|

|

Share - Related Items

Shares Outstanding: 141.60

Most Recent Split Date: (:1)

Beta: 0.75

Market Capitalization: $25,094.87 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 3.95% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.80 |

Indicated Annual Dividend: $7.00 |

| Current Fiscal Year EPS Consensus Estimate: $11.26 |

Payout Ratio: 0.62 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: -0.05 |

| Estmated Long-Term EPS Growth Rate: 5.07% |

Last Dividend Paid: 12/31/2025 - $1.75 |

| Next EPS Report Date: 04/29/26 |

|

|

|

| |