| Zacks Company Profile for Aviat Networks, Inc. (AVNW : NSDQ) |

|

|

| |

| • Company Description |

| Aviat Networks, Inc., previously known as Harris Stratex Networks, Inc., is a global supplier of wireless network solutions and network management software, backed by a suite of professional services and support. The Company offers advanced wireless IP network migration, preparing the way to the 4G/LTE future. It also offers transformational wireless solutions, including LTE-ready microwave backhaul, WiMAX access and a complete portfolio of essential service options that enable wireless public and private telecommunications operators to deliver advanced data, voice, video and mobility services around the world. In addition, Aviat offers professional services, including installation and commissioning and training. It serves mobile and fixed telephone service providers, private network operators, government agencies, transportation and utility companies, public safety agencies, and broadcast system operators. Aviat Networks, Inc. is headquartered in Morrisville, North Carolina.

Number of Employees: 923 |

|

|

| |

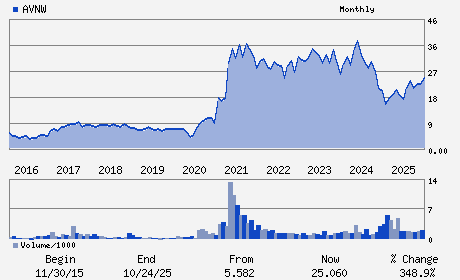

| • Price / Volume Information |

| Yesterday's Closing Price: $25.04 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 149,998 shares |

| Shares Outstanding: 12.90 (millions) |

| Market Capitalization: $323.07 (millions) |

| Beta: 0.83 |

| 52 Week High: $26.97 |

| 52 Week Low: $15.80 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

14.81% |

15.81% |

| 12 Week |

19.12% |

18.98% |

| Year To Date |

17.12% |

16.55% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Peter A. Smith - President and Chief Executive Officer and Director

John Mutch - Chairman

Michael Connaway - Senior Vice President and Chief Financial Officer

Laxmi Akkaraju - Director

Bryan Ingram - Director

|

|

Peer Information

Aviat Networks, Inc. (CMTL)

Aviat Networks, Inc. (UMAC)

Aviat Networks, Inc. (ANEN)

Aviat Networks, Inc. (ERIC)

Aviat Networks, Inc. (CLUS)

Aviat Networks, Inc. (BKTI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Wireless Equipment

Sector: Computer and Technology

CUSIP: 05366Y201

SIC: 3663

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 12.90

Most Recent Split Date: 4.00 (2.00:1)

Beta: 0.83

Market Capitalization: $323.07 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.33 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.97 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |