| Zacks Company Profile for Avantor, Inc. (AVTR : NYSE) |

|

|

| |

| • Company Description |

| Avantor Inc. is a provider of critical products and services primarily to biopharma, healthcare, education & government, advanced technologies & applied materials industries. Avantor Inc. is based in Radnor, United States.

Number of Employees: 13,500 |

|

|

| |

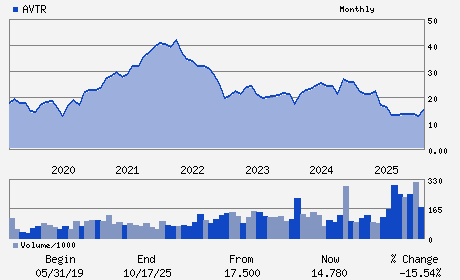

| • Price / Volume Information |

| Yesterday's Closing Price: $9.05 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 12,566,263 shares |

| Shares Outstanding: 682.06 (millions) |

| Market Capitalization: $6,172.61 (millions) |

| Beta: 0.97 |

| 52 Week High: $18.02 |

| 52 Week Low: $8.78 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-17.12% |

-16.40% |

| 12 Week |

-17.20% |

-17.30% |

| Year To Date |

-21.03% |

-21.41% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Emmanuel Ligner - President and Chief Executive Officer

Greg Summe - Chairman of the Board of Directors

R. Brent Jones - Executive Vice President and Chief Financial Offic

Steven Eck - Senior Vice President and Chief Accounting Officer

Juan Andres - Director

|

|

Peer Information

Avantor, Inc. (CHCR)

Avantor, Inc. (ESRX)

Avantor, Inc. (MYDP)

Avantor, Inc. (COR)

Avantor, Inc. (GBCS)

Avantor, Inc. (LAXAF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Medical Services

Sector: Medical

CUSIP: 05352A100

SIC: 3826

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/24/26

|

|

Share - Related Items

Shares Outstanding: 682.06

Most Recent Split Date: (:1)

Beta: 0.97

Market Capitalization: $6,172.61 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.16 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.79 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 3.23% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 04/24/26 |

|

|

|

| |