| Zacks Company Profile for Armstrong World Industries, Inc. (AWI : NYSE) |

|

|

| |

| • Company Description |

| Armstrong World is a leading global producer of ceiling systems for use primarily in the construction and renovation of commercial, institutional and residential buildings. It designs, manufactures and sells ceiling systems globally. WAVE operates plants in the United States to produce suspension system products. Armstrong World currently operates in three reporting segments - Mineral Fiber, Architectural Specialties and Unallocated Corporate. Mineral Fiber produces suspended mineral fiber and soft fiber ceiling systems for use in commercial and residential settings. Architectural Specialties produces and sources ceilings and walls for use in commercial settings. The Unallocated Corporate contains cash, debt, fully-funded U.S. pension plan and certain other miscellaneous balance-sheet items.

Number of Employees: 3,800 |

|

|

| |

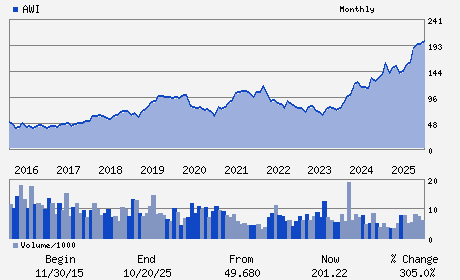

| • Price / Volume Information |

| Yesterday's Closing Price: $173.50 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 522,672 shares |

| Shares Outstanding: 42.83 (millions) |

| Market Capitalization: $7,431.71 (millions) |

| Beta: 1.33 |

| 52 Week High: $206.08 |

| 52 Week Low: $122.37 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.57% |

-4.75% |

| 12 Week |

-5.64% |

-5.76% |

| Year To Date |

-9.21% |

-9.65% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Victor D. Grizzle - President and Chief Executive Officer

Christopher P. Calzaretta - Senior Vice President and Chief Financial Officer

James T. Burge - Vice President and Controller

Richard D. Holder - Director

Kevin P. Holleran - Director

|

|

Peer Information

Armstrong World Industries, Inc. (CSRLY)

Armstrong World Industries, Inc. (ARRD)

Armstrong World Industries, Inc. (CGMCQ)

Armstrong World Industries, Inc. (CMCJY)

Armstrong World Industries, Inc. (OMRP)

Armstrong World Industries, Inc. (ABLT)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BLDG&CONST-MISC

Sector: Construction

CUSIP: 04247X102

SIC: 3089

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/05/26

|

|

Share - Related Items

Shares Outstanding: 42.83

Most Recent Split Date: (:1)

Beta: 1.33

Market Capitalization: $7,431.71 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.78% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.84 |

Indicated Annual Dividend: $1.36 |

| Current Fiscal Year EPS Consensus Estimate: $8.35 |

Payout Ratio: 0.18 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: 10.84% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/05/26 |

|

|

|

| |