| Zacks Company Profile for AxoGen, Inc. (AXGN : NSDQ) |

|

|

| |

| • Company Description |

| AxoGen, Inc. engages in developing and marketing surgical solutions for peripheral nerves. The company's portfolio of products includes Avance Nerve Graft(R), AxoGuard Nerve Connector(R), AxoGuard Nerve Protector(R), Avive Soft Tissue Membrane(R), AcroVal Neurosensory & Motor Testing System(R) and AxoTouch Two-Point Discriminator(R). It operates primarily in the United States, Canada, the United Kingdom, and other European and international countries. AxoGen Inc., formerly known as AxoGen Corp., is based in FL, United States.

Number of Employees: 622 |

|

|

| |

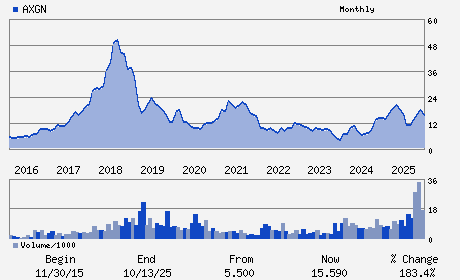

| • Price / Volume Information |

| Yesterday's Closing Price: $31.73 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 944,561 shares |

| Shares Outstanding: 51.90 (millions) |

| Market Capitalization: $1,646.71 (millions) |

| Beta: 0.98 |

| 52 Week High: $36.00 |

| 52 Week Low: $9.22 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-8.95% |

-8.16% |

| 12 Week |

-4.77% |

-4.89% |

| Year To Date |

-3.06% |

-3.53% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Michael J. Dale - Chief Executive Officer and President

Paul G. Thomas - Chairman

Lindsey Hartley - Chief Financial Officer

John H. Johnson - Director

Alan M. Levine - Director

|

|

Peer Information

AxoGen, Inc. (ABMD)

AxoGen, Inc. (DMDS)

AxoGen, Inc. (CPWY.)

AxoGen, Inc. (EQUR)

AxoGen, Inc. (ECIA)

AxoGen, Inc. (FMS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED INSTRUMENTS

Sector: Medical

CUSIP: 05463X106

SIC: 3845

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 51.90

Most Recent Split Date: 7.00 (1.05:1)

Beta: 0.98

Market Capitalization: $1,646.71 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.12 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.08 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |