| Zacks Company Profile for Axon Enterprise, Inc (AXON : NSDQ) |

|

|

| |

| • Company Description |

| Axon Enterprise, Inc. engages in the development, manufacture and sale of conducted electrical weapons for the law enforcement, federal, military, corrections, private security and personal defense markets. Its operating segment consists of TASER Weapons and Axon segments. TASER Weapons segment involves in the sale of conducted electrical weapons, accessories and other products and services. Axon segment focuses on devices, wearables, applications, cloud and mobile products. Axon Enterprise Inc., formerly known as TASER International Inc., is headquartered in Scottsdale, AZ.

Number of Employees: 6,300 |

|

|

| |

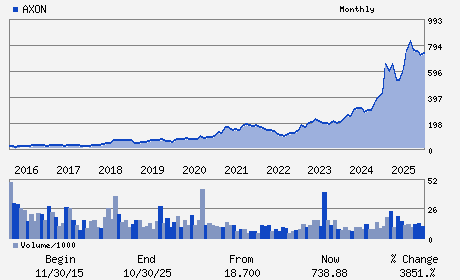

| • Price / Volume Information |

| Yesterday's Closing Price: $542.40 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,372,675 shares |

| Shares Outstanding: 80.40 (millions) |

| Market Capitalization: $43,607.70 (millions) |

| Beta: 1.46 |

| 52 Week High: $885.92 |

| 52 Week Low: $396.41 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

12.16% |

13.14% |

| 12 Week |

-1.55% |

-1.67% |

| Year To Date |

-4.50% |

-4.96% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

17800 NORTH 85TH STREET

-

SCOTTSDALE,AZ 85255

USA |

ph: 480-991-0797

fax: 480-991-0791 |

ir@axon.com |

http://www.axon.com |

|

|

| |

| • General Corporate Information |

Officers

Patrick Smith - Chief Executive Officer

Brittany Bagley - Chief Operating Officer and Chief Financial Office

Jennifer Mak - Chief Accounting Officer

Julie Cullivan - Director

Hadi Partovi - Director

|

|

Peer Information

Axon Enterprise, Inc (T.CAE)

Axon Enterprise, Inc (ADGI.)

Axon Enterprise, Inc (CVU)

Axon Enterprise, Inc (CW)

Axon Enterprise, Inc (DCO)

Axon Enterprise, Inc (DRS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AEROSP/DEF EQ

Sector: Aerospace

CUSIP: 05464C101

SIC: 3480

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 80.40

Most Recent Split Date: 11.00 (2.00:1)

Beta: 1.46

Market Capitalization: $43,607.70 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.13 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $1.33 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 33.23% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |