| Zacks Company Profile for Barrett Business Services, Inc. (BBSI : NSDQ) |

|

|

| |

| • Company Description |

| BARRETT BUSINESS SERVICES INC. provides light industrial, clerical and technical employees to a wide range of businesses through staff leasing, contract staffing, site management and temporary staffing arrangements. The Company provides employees to a diverse set of customers, including among others, forest products and agriculture-based companies, electronics manufacturers, transportation and shipping enterprises, professional firms and general contractors.

Number of Employees: 3,658 |

|

|

| |

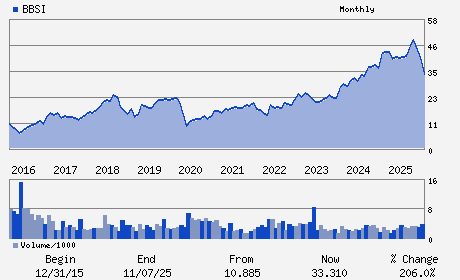

| • Price / Volume Information |

| Yesterday's Closing Price: $27.77 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 264,476 shares |

| Shares Outstanding: 25.20 (millions) |

| Market Capitalization: $699.89 (millions) |

| Beta: 1.03 |

| 52 Week High: $49.65 |

| 52 Week Low: $25.33 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-26.92% |

-26.28% |

| 12 Week |

-19.58% |

-19.68% |

| Year To Date |

-23.31% |

-23.68% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

8100 NE PARKWAY DRIVE SUITE 200

-

VANCOUVER,WA 98662

USA |

ph: 360-828-0700

fax: 360-828-0701 |

bbsi@gatewayir.com |

http://www.bbsi.com |

|

|

| |

| • General Corporate Information |

Officers

Gary E. Kramer - Chief ExecutiveOfficer and President

Joseph S. Clabby - Chairman of the Board

Anthony J. Harris - Executive Vice President and Chief Financial Offic

Thomas J. Carley - Director

Thomas B. Cusick - Director

|

|

Peer Information

Barrett Business Services, Inc. (CGEMY)

Barrett Business Services, Inc. (GLXG)

Barrett Business Services, Inc. (SRT)

Barrett Business Services, Inc. (CVG)

Barrett Business Services, Inc. (HEW)

Barrett Business Services, Inc. (BBSI)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: Outsourcing

Sector: Business Services

CUSIP: 068463108

SIC: 7363

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 25.20

Most Recent Split Date: 6.00 (4.00:1)

Beta: 1.03

Market Capitalization: $699.89 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.15% |

| Current Fiscal Quarter EPS Consensus Estimate: $-0.12 |

Indicated Annual Dividend: $0.32 |

| Current Fiscal Year EPS Consensus Estimate: $2.15 |

Payout Ratio: 0.15 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: -0.04 |

| Estmated Long-Term EPS Growth Rate: 16.00% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |