| Zacks Company Profile for Bright Horizons Family Solutions Inc. (BFAM : NYSE) |

|

|

| |

| • Company Description |

| Bright Horizons Family Solutions Inc. is engaged in providing employer-sponsored child care, early education and work/life solutions. Its employer-sponsored child care programs include child care and early education centers, infant/toddler/preschool care and education, full and part-time child care, kindergarten, school-age programs, summer camps and back-up care. Bright Horizons manages child care centers for corporations, hospitals, universities and government agencies The Company operates primarily in North America, Europe and India. Bright Horizons Family Solutions Inc. is based in Watertown, Massachusetts.

Number of Employees: 32,200 |

|

|

| |

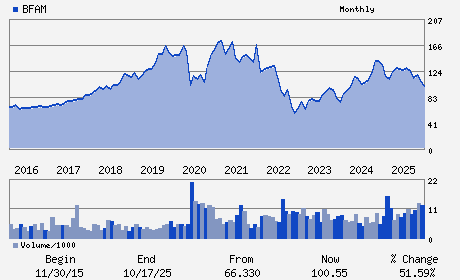

| • Price / Volume Information |

| Yesterday's Closing Price: $74.52 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,338,335 shares |

| Shares Outstanding: 55.11 (millions) |

| Market Capitalization: $4,107.07 (millions) |

| Beta: 1.42 |

| 52 Week High: $132.99 |

| 52 Week Low: $63.68 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-19.55% |

-18.85% |

| 12 Week |

-27.75% |

-27.84% |

| Year To Date |

-26.51% |

-26.87% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Stephen H. Kramer - Director; Chief Executive Officer and President

David Lissy - Director; Chair

Elizabeth Boland - Chief Financial Officer

Jason Janoff - Chief Accounting Officer

Lawrence Alleva - Director

|

|

Peer Information

Bright Horizons Family Solutions Inc. (AGIS)

Bright Horizons Family Solutions Inc. (SKCO)

Bright Horizons Family Solutions Inc. (AWWC)

Bright Horizons Family Solutions Inc. (AQUX)

Bright Horizons Family Solutions Inc. (AVSV)

Bright Horizons Family Solutions Inc. (AMGC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BUSINESS SVCS

Sector: Business Services

CUSIP: 109194100

SIC: 8351

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 55.11

Most Recent Split Date: (:1)

Beta: 1.42

Market Capitalization: $4,107.07 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.68 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $4.60 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 11.28% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |