| Zacks Company Profile for BILL Holdings, Inc. (BILL : NYSE) |

|

|

| |

| • Company Description |

| BILL Holdings Inc. provides cloud-based software which simplifies, digitizes and automates back-office financial operations for small and midsize businesses. BILL Holdings Inc., formerly known as Bill.com Holdings Inc., is based in San Jose, California.

Number of Employees: 2,364 |

|

|

| |

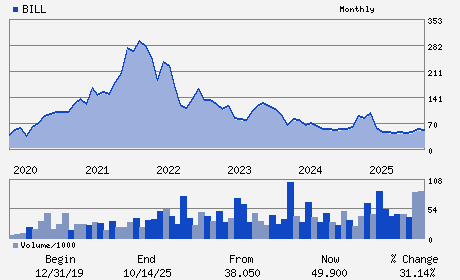

| • Price / Volume Information |

| Yesterday's Closing Price: $44.51 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 3,870,926 shares |

| Shares Outstanding: 98.96 (millions) |

| Market Capitalization: $4,404.73 (millions) |

| Beta: 1.25 |

| 52 Week High: $57.21 |

| 52 Week Low: $35.46 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.10% |

4.01% |

| 12 Week |

-16.73% |

-16.83% |

| Year To Date |

-18.39% |

-18.79% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

6220 AMERICA CENTER DRIVE SUITE 100

-

SAN JOSE,CA 95002

USA |

ph: 650-621-7700

fax: - |

investor@ir.bill.com |

http://www.bill.com |

|

|

| |

| • General Corporate Information |

Officers

Rene Lacerte - Chief Executive Officer and Director

Rohini Jain - Chief Financial Officer

Germaine Cota - Senior Vice President; Finance and Principal Accou

Aida Alvarez - Director

Steven Cakebread - Director

|

|

Peer Information

BILL Holdings, Inc. (ADP)

BILL Holdings, Inc. (CWLD)

BILL Holdings, Inc. (CYBA.)

BILL Holdings, Inc. (ZVLO)

BILL Holdings, Inc. (AZPN)

BILL Holdings, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 090043100

SIC: 7372

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/14/26

|

|

Share - Related Items

Shares Outstanding: 98.96

Most Recent Split Date: (:1)

Beta: 1.25

Market Capitalization: $4,404.73 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.08 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.56 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: 15.19% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/14/26 |

|

|

|

| |