| Zacks Company Profile for Bio-Rad Laboratories, Inc. (BIO : NYSE) |

|

|

| |

| • Company Description |

| Bio-Rad Laboratories is a manufacturer and global supplier of clinical diagnostics and life science research products in the healthcare, analytical chemistry life science research and other markets. It offers a wide portfolio of products and systems which allow the separation of complex chemical and biological materials and discovery, analysis and purification of their components. Bio-Rad has extensive and direct distribution channels outside the United States through subsidiaries which focus on sales, customer service and product distribution. The company operates through two reportable segments - Life Science segment which designs, manufactures, markets and services reagents, apparatus and instruments utilized for biological research. Clinical Diagnostics - This business markets and distributes products to reference laboratories, hospital laboratories, state newborn screening facilities, physicians office laboratories, transfusion laboratories as well as insurance and forensic testing laboratories.

Number of Employees: 7,450 |

|

|

| |

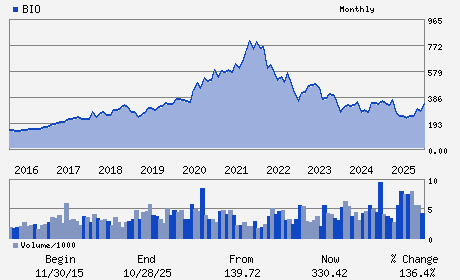

| • Price / Volume Information |

| Yesterday's Closing Price: $279.59 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 312,150 shares |

| Shares Outstanding: 26.99 (millions) |

| Market Capitalization: $7,546.24 (millions) |

| Beta: 1.18 |

| 52 Week High: $343.12 |

| 52 Week Low: $211.43 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-6.00% |

-4.70% |

| 12 Week |

-9.38% |

-9.84% |

| Year To Date |

-7.72% |

-8.21% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

1000 ALFRED NOBEL DRIVE

-

HERCULES,CA 94547

USA |

ph: 510-724-7000

fax: 510-741-5817 |

ir@bio-rad.com |

http://www.bio-rad.com |

|

|

| |

| • General Corporate Information |

Officers

Norman Schwartz - Chief Executive Officer and Chairman

Roop K. Lakkaraju - Chief Financial Officer and Executive Vice Preside

Jeffrey L. Edwards - Director

Gregory K. Hinckley - Director

Melinda Litherland - Director

|

|

Peer Information

Bio-Rad Laboratories, Inc. (BJCT)

Bio-Rad Laboratories, Inc. (CADMQ)

Bio-Rad Laboratories, Inc. (APNO)

Bio-Rad Laboratories, Inc. (UPDC)

Bio-Rad Laboratories, Inc. (IMTIQ)

Bio-Rad Laboratories, Inc. (CYGN)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED PRODUCTS

Sector: Medical

CUSIP: 090572207

SIC: 3826

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 26.99

Most Recent Split Date: 3.00 (2.00:1)

Beta: 1.18

Market Capitalization: $7,546.24 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.77 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $10.32 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 1.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |