| Zacks Company Profile for Badger Meter, Inc. (BMI : NYSE) |

|

|

| |

| • Company Description |

| Badger Meter, Inc. provides flow measurement, control and communications solutions, serving water and gas utilities, municipalities and industrial customers worldwide. The company's products measure water, oil, chemicals, and other fluids, and are known for accuracy, long-lasting durability and for providing valuable and timely measurement data. The company offers BEACON advanced metering analytics, a secure cloud-hosted software suite that allows consumer engagement tools that permit end water customers to view and manage their water usage activity. It also provides ORION Migratable for automatic meter reading and ORION Cellular for infrastructure-free fixed network meter reading solution. Badger Meter's product lines fall into two categories - sales of water meters, radios and related technologies to municipal water utilities (municipal water) and sales of meters, valves and other products for industrial applications in water, wastewater and other industries (flow instrumentation).

Number of Employees: 2,477 |

|

|

| |

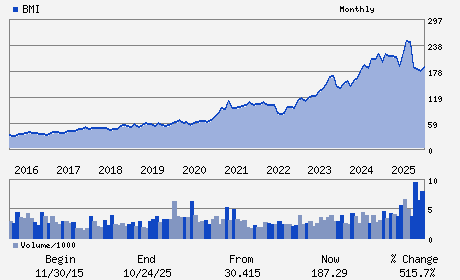

| • Price / Volume Information |

| Yesterday's Closing Price: $152.20 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 416,741 shares |

| Shares Outstanding: 29.18 (millions) |

| Market Capitalization: $4,441.44 (millions) |

| Beta: 0.87 |

| 52 Week High: $256.08 |

| 52 Week Low: $139.14 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

0.24% |

1.62% |

| 12 Week |

-14.20% |

-14.63% |

| Year To Date |

-12.73% |

-13.19% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Kenneth C. Bockhorst - Chairman; President and Chief Executive Officer an

Daniel R. Weltzien - Vice President - Chief Financial Officer and Treas

Christina M. Tarantino - Vice President - Controller

Todd A. Adams - Director

Henry F. Brooks - Director

|

|

Peer Information

Badger Meter, Inc. (BEIQ)

Badger Meter, Inc. (THR)

Badger Meter, Inc. (EDCO)

Badger Meter, Inc. (TRCI)

Badger Meter, Inc. (MOCO)

Badger Meter, Inc. (ACSEF)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INSTRU-CONTROL

Sector: Computer and Technology

CUSIP: 056525108

SIC: 3824

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/16/26

|

|

Share - Related Items

Shares Outstanding: 29.18

Most Recent Split Date: 9.00 (2.00:1)

Beta: 0.87

Market Capitalization: $4,441.44 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 1.05% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.22 |

Indicated Annual Dividend: $1.60 |

| Current Fiscal Year EPS Consensus Estimate: $5.03 |

Payout Ratio: 0.33 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: -0.02 |

| Estmated Long-Term EPS Growth Rate: 12.37% |

Last Dividend Paid: 02/27/2026 - $0.40 |

| Next EPS Report Date: 04/16/26 |

|

|

|

| |