| Zacks Company Profile for BioMarin Pharmaceutical Inc. (BMRN : NSDQ) |

|

|

| |

| • Company Description |

| BioMarin Pharmaceutical Inc. focuses on the development and commercialization of treatments for serious life-threatening medical conditions, mostly for children. The company's portfolio comprises seven marketed products namely, Aldurazyme, Naglazyme, Kuvan a rare genetic enzyme deficiency disorder), Vimizim , Brineura, Palynziq and Voxzogo. BioMarin has a collaboration agreement with Sanofi's subsidiary Genzyme for Aldurazyme. Genzyme is BioMarin's sole customer for Aldurazyme and is responsible for marketing and selling Aldurazyme to third parties.?The newest drug in BioMarin's portfolio, Voxzogo for treating achondroplasia, the most common form of dwarfism. BioMarin's biologics license application (BLA) for Roctavian/valoctocogene roxaparvovec (valrox), a gene therapy for severe hemophilia A, was given a complete response letter (CRL) by the FDA.

Number of Employees: 3,221 |

|

|

| |

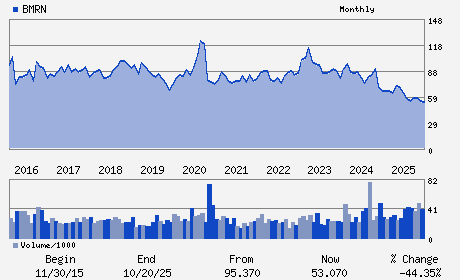

| • Price / Volume Information |

| Yesterday's Closing Price: $59.74 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,315,900 shares |

| Shares Outstanding: 192.32 (millions) |

| Market Capitalization: $11,489.40 (millions) |

| Beta: 0.25 |

| 52 Week High: $73.51 |

| 52 Week Low: $50.76 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.09% |

4.51% |

| 12 Week |

12.08% |

11.51% |

| Year To Date |

0.52% |

-0.01% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

770 Lindaro Street

-

San Rafael,CA 94901

USA |

ph: 415-506-6700

fax: 415-382-7889 |

ir@bmrn.com |

http://www.biomarin.com |

|

|

| |

| • General Corporate Information |

Officers

Alexander Hardy - President and Chief Executive Officer

Richard A. Meier - Chairman

Brian R. Mueller - Executive Vice President and Chief Financial Offic

Rashmi Ramchandani - Vice President

Elizabeth McKee Anderson - Director

|

|

Peer Information

BioMarin Pharmaceutical Inc. (CORR.)

BioMarin Pharmaceutical Inc. (RSPI)

BioMarin Pharmaceutical Inc. (CGXP)

BioMarin Pharmaceutical Inc. (BGEN)

BioMarin Pharmaceutical Inc. (GTBP)

BioMarin Pharmaceutical Inc. (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 09061G101

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 192.32

Most Recent Split Date: (:1)

Beta: 0.25

Market Capitalization: $11,489.40 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.97 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $4.45 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 7.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 25.92% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |