| Zacks Company Profile for Bristol Myers Squibb Company (BMY : NYSE) |

|

|

| |

| • Company Description |

| Bristol-Myers Squibb is a one of the leading global specialty biopharmaceutical companies focused on the development of treatments targeting serious diseases like cancer, inflammatory, immunologic, cardiovascular or fibrotic diseases. Backed by its blockbuster immuno-oncology drug, Opdivo, Bristol-Myers has a strong oncology portfolio, comprising other drugs like Revlimid, Pomalyst, Sprycel, Yervoy and Empliciti. It also has important immunology and cardiovascular drugs like Orencia and Eliquis. It's experiencing growth in both the Eliquis brand and the market, while also advancing its Factor XIa inhibitor program. After the sale of the global Diabetes business to AstraZeneca and the discontinuation of discovery research efforts in virology, it's focusing solely on research in core therapeutic areas like oncology, immuno-oncology, immunoscience, cardiovascular, fibrosis and genetically defined diseases. It acquried Celgene Corporation and MyoKardia. It received regulatory approvals for Reblozyl and Inrebic.

Number of Employees: 32,500 |

|

|

| |

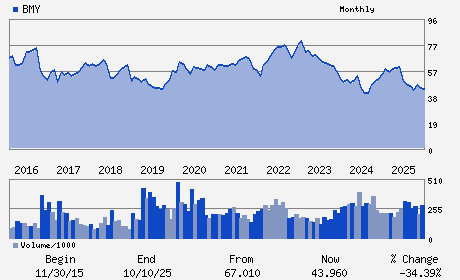

| • Price / Volume Information |

| Yesterday's Closing Price: $62.34 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 13,575,286 shares |

| Shares Outstanding: 2,036.47 (millions) |

| Market Capitalization: $126,953.77 (millions) |

| Beta: 0.26 |

| 52 Week High: $63.33 |

| 52 Week Low: $42.52 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

11.54% |

13.08% |

| 12 Week |

20.65% |

20.03% |

| Year To Date |

15.57% |

14.97% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Christopher Boerner - Chairman and Chief Executive Officer

David V. Elkins - Chief Financial Officer

Phil M. Holzer - Senior Vice President and Corporate Controller

Peter J. Arduini - Director

Deepak L. Bhatt - Director

|

|

Peer Information

Bristol Myers Squibb Company (CORR.)

Bristol Myers Squibb Company (RSPI)

Bristol Myers Squibb Company (CGXP)

Bristol Myers Squibb Company (BGEN)

Bristol Myers Squibb Company (GTBP)

Bristol Myers Squibb Company (RGRX)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: MED-BIOMED/GENE

Sector: Medical

CUSIP: 110122108

SIC: 2834

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/23/26

|

|

Share - Related Items

Shares Outstanding: 2,036.47

Most Recent Split Date: 3.00 (2.00:1)

Beta: 0.26

Market Capitalization: $126,953.77 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 4.04% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.46 |

Indicated Annual Dividend: $2.52 |

| Current Fiscal Year EPS Consensus Estimate: $6.27 |

Payout Ratio: 0.40 |

| Number of Estimates in the Fiscal Year Consensus: 13.00 |

Change In Payout Ratio: -0.25 |

| Estmated Long-Term EPS Growth Rate: 55.97% |

Last Dividend Paid: 01/02/2026 - $0.63 |

| Next EPS Report Date: 04/23/26 |

|

|

|

| |