| Zacks Company Profile for Popular, Inc. (BPOP : NSDQ) |

|

|

| |

| • Company Description |

| Popular, Inc. is a diversified, publicly owned bank holding company. The corporation's principal subsidiary, Banco Popular de Puerto Rico, has one of the largest retail franchise in Puerto Rico, operating numerous branches and automated teller machines. The Bank also operates branches in the U.S. Virgin Islands, the British Virgin Islands, and New York.

Number of Employees: 9,406 |

|

|

| |

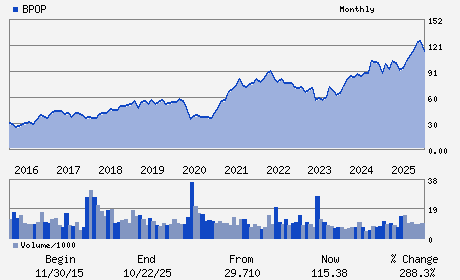

| • Price / Volume Information |

| Yesterday's Closing Price: $135.36 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 565,101 shares |

| Shares Outstanding: 66.68 (millions) |

| Market Capitalization: $9,025.11 (millions) |

| Beta: 0.61 |

| 52 Week High: $149.31 |

| 52 Week Low: $78.23 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

1.37% |

2.26% |

| 12 Week |

16.40% |

16.25% |

| Year To Date |

8.71% |

8.18% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Ignacio Alvarez - Chief Executive Officer

Richard L. Carrion - Chairman

Jorge J. Garcia - Vice President; Principal Financial Officer

Alejandro M. Ballester - Director

Robert Carrady - Director

|

|

Peer Information

Popular, Inc. (TSFG)

Popular, Inc. (ABCB)

Popular, Inc. (CFNL)

Popular, Inc. (CPKF)

Popular, Inc. (HIB)

Popular, Inc. (FVB)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: BANKS-SOUTHEAST

Sector: Finance

CUSIP: 733174700

SIC: 6022

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 04/22/26

|

|

Share - Related Items

Shares Outstanding: 66.68

Most Recent Split Date: 5.00 (0.10:1)

Beta: 0.61

Market Capitalization: $9,025.11 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.22% |

| Current Fiscal Quarter EPS Consensus Estimate: $3.32 |

Indicated Annual Dividend: $3.00 |

| Current Fiscal Year EPS Consensus Estimate: $14.31 |

Payout Ratio: 0.25 |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: 11.27% |

Last Dividend Paid: 12/05/2025 - $0.75 |

| Next EPS Report Date: 04/22/26 |

|

|

|

| |