| Zacks Company Profile for Broadridge Financial Solutions, Inc. (BR : NYSE) |

|

|

| |

| • Company Description |

| Broadridge is a global financial technology company that offers investor communications and technology-driven solutions to banks, broker-dealers, asset managers and corporate issuers. The company is a leading producer and distributor of a variety of documents, widely used in the financial industry including proxies, annual reports, prospectuses and trade confirmations. The company classifies its operations into the following two reportable segments: Investor Communication Solutions and Global Technology and Operations. Investor Communication Solutions offers Bank/Broker-Dealer Investor Communication, Customer Communication, Advisor, Corporate Issuer, and Mutual Fund and Retirement Solutions. Global Technology and Operations offers middle- and back-office securities processing solutions including desktop productivity tools, data aggregation, portfolio management, order capture and execution, performance reporting, trade confirmation, margin, cash management, and securities financing.

Number of Employees: 15,000 |

|

|

| |

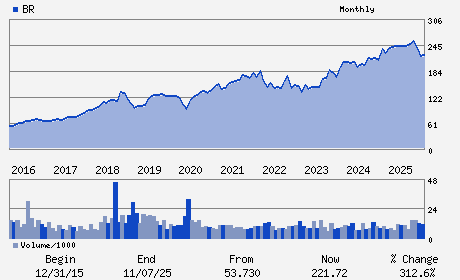

| • Price / Volume Information |

| Yesterday's Closing Price: $186.50 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 1,635,319 shares |

| Shares Outstanding: 116.75 (millions) |

| Market Capitalization: $21,773.63 (millions) |

| Beta: 0.98 |

| 52 Week High: $271.91 |

| 52 Week Low: $163.71 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-5.97% |

-4.67% |

| 12 Week |

-18.04% |

-18.45% |

| Year To Date |

-16.43% |

-16.87% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Timothy C. Gokey - Chief Executive Officer and Director

Richard J. Daly - Executive Chairman of the Board of Director

Ashima Ghei - Corporate Vice President; Chief Financial Officer

Eileen K. Murray - Lead Independent Director

Pamela L. Carter - Director

|

|

Peer Information

Broadridge Financial Solutions, Inc. (ADP)

Broadridge Financial Solutions, Inc. (CWLD)

Broadridge Financial Solutions, Inc. (CYBA.)

Broadridge Financial Solutions, Inc. (ZVLO)

Broadridge Financial Solutions, Inc. (AZPN)

Broadridge Financial Solutions, Inc. (ATIS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INTERNET SOFTWARE

Sector: Computer and Technology

CUSIP: 11133T103

SIC: 7389

|

|

Fiscal Year

Fiscal Year End: June

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/07/26

|

|

Share - Related Items

Shares Outstanding: 116.75

Most Recent Split Date: (:1)

Beta: 0.98

Market Capitalization: $21,773.63 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 2.09% |

| Current Fiscal Quarter EPS Consensus Estimate: $2.63 |

Indicated Annual Dividend: $3.90 |

| Current Fiscal Year EPS Consensus Estimate: $9.51 |

Payout Ratio: 0.43 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: 12/12/2025 - $0.98 |

| Next EPS Report Date: 05/07/26 |

|

|

|

| |