| Zacks Company Profile for Bruker Corporation (BRKR : NSDQ) |

|

|

| |

| • Company Description |

| Bruker Corp designs & manufactures proprietary life science & materials research systems & associated products that serve multiple customers in life science research, pharmaceuticals, applied markets, nanotechnology, cell biology, clinical research, microbiology & in-vitro diagnostics. BSI Life Science reports under two groups: Bruker BioSpin Group & Bruker CALID Group. The Bruker BioSpin comprises the Bruker Magnetic Resonance & Preclinical Imaging divisions, which designs, manufactures & distributes enabling life science tools based on the magnetic resonance technology. The Bruker CALID comprises the Bruker Daltonics & primarily designs, manufactures & distributes life-science mass spectrometry instruments that can be integrated with other sample preparation or chromatography instruments. BSI Nano designs, manufactures & distributes advanced X-ray instruments to determine the characteristics of matter & the three-dimensional structure of molecules.

Number of Employees: 11,396 |

|

|

| |

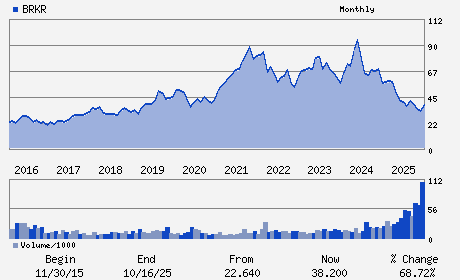

| • Price / Volume Information |

| Yesterday's Closing Price: $39.81 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 2,443,783 shares |

| Shares Outstanding: 152.22 (millions) |

| Market Capitalization: $6,059.85 (millions) |

| Beta: 1.19 |

| 52 Week High: $56.22 |

| 52 Week Low: $28.53 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-9.01% |

-7.75% |

| 12 Week |

-13.46% |

-13.90% |

| Year To Date |

-15.50% |

-15.94% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Frank H. Laukien - President; Chief Executive Officer and Chairman

Gerald N. Herman - Executive Vice President and Chief Financial Offic

Thomas M. Bures - Chief Accounting Officer

Bonnie H. Anderson - Director

William A. Linton - Director

|

|

Peer Information

Bruker Corporation (DNEX)

Bruker Corporation (T.PUR)

Bruker Corporation (CALP.)

Bruker Corporation (CCSI.)

Bruker Corporation (NEWP.)

Bruker Corporation (PBSC)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: INSTRU-SCIENTFC

Sector: Computer and Technology

CUSIP: 116794108

SIC: 3826

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/06/26

|

|

Share - Related Items

Shares Outstanding: 152.22

Most Recent Split Date: (:1)

Beta: 1.19

Market Capitalization: $6,059.85 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.50% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.26 |

Indicated Annual Dividend: $0.20 |

| Current Fiscal Year EPS Consensus Estimate: $2.12 |

Payout Ratio: 0.11 |

| Number of Estimates in the Fiscal Year Consensus: 5.00 |

Change In Payout Ratio: 0.02 |

| Estmated Long-Term EPS Growth Rate: 7.88% |

Last Dividend Paid: 12/08/2025 - $0.05 |

| Next EPS Report Date: 05/06/26 |

|

|

|

| |