| Zacks Company Profile for Burberry Group PLC (BURBY : OTC) |

|

|

| |

| • Company Description |

| Burberry Group plc is engaged in the designing, sourcing, manufacturing and marketing of luxury clothing and non-apparel accessories. The Company's products include outerwear, fragrance and beauty products, eyewear, watches, trench coats, small leather goods, handbags, totes and mufflers, scarves, shoes, belts and jewellery. It sells through a diversified network of retail, digital, wholesale and licensing channels worldwide. Burberry Group plc is headquartered in London, the United Kingdom.

Number of Employees: 8,459 |

|

|

| |

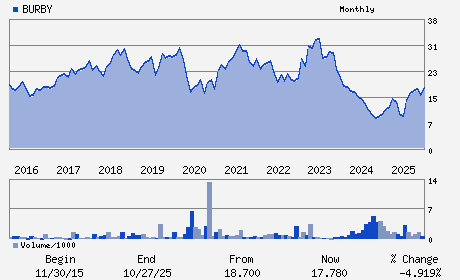

| • Price / Volume Information |

| Yesterday's Closing Price: $14.85 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 33,006 shares |

| Shares Outstanding: 360.99 (millions) |

| Market Capitalization: $5,359.68 (millions) |

| Beta: 1.12 |

| 52 Week High: $18.55 |

| 52 Week Low: $8.00 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

-1.35% |

0.01% |

| 12 Week |

-7.55% |

-8.02% |

| Year To Date |

-12.87% |

-13.33% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Joshua Schulman - Chief Executive Officer

Gerry Murphy - Chairman

Kate Ferry - Chief Financial Officer

Gemma Parsons - Company Secretary

Orna NiChionna - Director

|

|

Peer Information

Burberry Group PLC (CACH)

Burberry Group PLC (DXLG)

Burberry Group PLC (HIBB)

Burberry Group PLC (WALKQ)

Burberry Group PLC (BDST)

Burberry Group PLC (CBKCQ)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-APP/SHOE

Sector: Retail/Wholesale

CUSIP: 12082W204

SIC: 8880

|

|

Fiscal Year

Fiscal Year End: March

Last Reported Quarter: -

Next Expected EPS Date: -

|

|

Share - Related Items

Shares Outstanding: 360.99

Most Recent Split Date: 2.00 (2.00:1)

Beta: 1.12

Market Capitalization: $5,359.68 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.27 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $0.28 |

Payout Ratio: |

| Number of Estimates in the Fiscal Year Consensus: 3.00 |

Change In Payout Ratio: |

| Estmated Long-Term EPS Growth Rate: % |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: - |

|

|

|

| |