| Zacks Company Profile for Burlington Stores, Inc. (BURL : NYSE) |

|

|

| |

| • Company Description |

| Burlington Stores, Inc. functions as a retailer of branded apparel products. It operates in the United States and Puerto Rico. The company offers products such as ladies sportswear, menswear, youth apparel, baby furniture, accessories, home d?cor and gifts, and coats. The company which started business as a coat-focused off-price retailer is now focusing on 'open to buy' off-price model. The current model is helping customers to get nationally branded, fashionable, high quality as well as right priced products. Burlington Stores' wider selection provides a broad range of apparel, accessories and furnishings for all age groups. Burlington Stores provide customers a full line of assortments, comprising - women's ready-to-wear apparel, accessories, footwear, menswear, youth apparel, baby, home, coats, beauty, toys and gifts.

Number of Employees: 77,532 |

|

|

| |

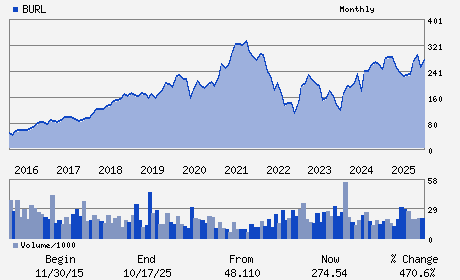

| • Price / Volume Information |

| Yesterday's Closing Price: $306.87 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 712,879 shares |

| Shares Outstanding: 62.93 (millions) |

| Market Capitalization: $19,310.41 (millions) |

| Beta: 1.73 |

| 52 Week High: $332.20 |

| 52 Week Low: $212.92 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

3.72% |

4.63% |

| 12 Week |

12.91% |

12.77% |

| Year To Date |

6.24% |

5.72% |

|

|

|

|

| |

|

|

| |

| • General Corporate Information |

Officers

Michael O'Sullivan - Chief Executive Officer

Kristin Wolfe - Chief Financial Officer

Ted English - Director

Shira Goodman - Director

Michael Goodwin - Director

|

|

Peer Information

Burlington Stores, Inc. (TGT)

Burlington Stores, Inc. (BURL)

Burlington Stores, Inc. (ALCSQ)

Burlington Stores, Inc. (CLDRQ)

Burlington Stores, Inc. (BLEEQ)

Burlington Stores, Inc. (FDO)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: RETAIL-DISCOUNT

Sector: Retail/Wholesale

CUSIP: 122017106

SIC: 5311

|

|

Fiscal Year

Fiscal Year End: January

Last Reported Quarter: 10/01/25

Next Expected EPS Date: 03/05/26

|

|

Share - Related Items

Shares Outstanding: 62.93

Most Recent Split Date: (:1)

Beta: 1.73

Market Capitalization: $19,310.41 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.00% |

| Current Fiscal Quarter EPS Consensus Estimate: $1.85 |

Indicated Annual Dividend: $0.00 |

| Current Fiscal Year EPS Consensus Estimate: $10.97 |

Payout Ratio: 0.00 |

| Number of Estimates in the Fiscal Year Consensus: 6.00 |

Change In Payout Ratio: 0.00 |

| Estmated Long-Term EPS Growth Rate: 16.15% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 03/05/26 |

|

|

|

| |