| Zacks Company Profile for BWX Technologies, Inc. (BWXT : NYSE) |

|

|

| |

| • Company Description |

| BWX Technologies, Inc. supplies precision manufactured components and services to the commercial nuclear power industry. The company offers technical, management and site services to governments in complex facilities and environmental remediation activities. It operates primarily in Lynchburg, Va., Ohio and Cambridge, Ontario. BWX Technologies, Inc., formerly known as Babcock & Wilcox Company, is headquartered in Lynchburg, Va.

Number of Employees: 10,400 |

|

|

| |

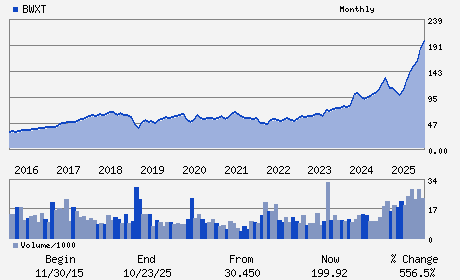

| • Price / Volume Information |

| Yesterday's Closing Price: $216.47 |

Daily Weekly Monthly

|

| 20 Day Moving Average: 905,368 shares |

| Shares Outstanding: 91.44 (millions) |

| Market Capitalization: $19,795.12 (millions) |

| Beta: 0.83 |

| 52 Week High: $220.57 |

| 52 Week Low: $84.21 |

| Short Interest Ratio: |

| |

% Price Change |

% Price Change Relative to S&P 500 |

| 4 Week |

5.06% |

6.51% |

| 12 Week |

21.10% |

20.48% |

| Year To Date |

25.24% |

24.59% |

|

|

|

|

| |

| • Address & Contact Information |

| Street Address |

Phone / Fax |

Email Address |

Web URL |

800 MAIN STREET 4TH FLOOR

-

LYNCHBURG,VA 24504

USA |

ph: 980-365-4300

fax: 434-522-6909 |

investors@bwxt.com |

http://www.bwxt.com |

|

|

| |

| • General Corporate Information |

Officers

Rex D. Geveden - President; Chief Executive Officer and Director

Jan A. Bertsch - Chairman

Mike T. Fitzgerald - Senior Vice President and Chief Financial Officer

Kevin J. Gorman - Vice President and Chief Accounting Officer

Gerhard F. Burbach - Director

|

|

Peer Information

BWX Technologies, Inc. (T.CAE)

BWX Technologies, Inc. (ADGI.)

BWX Technologies, Inc. (CVU)

BWX Technologies, Inc. (CW)

BWX Technologies, Inc. (DCO)

BWX Technologies, Inc. (DRS)

|

|

Industry / Sector / Ticker Info

Analyst Coverage: No

Industry Group: AEROSP/DEF EQ

Sector: Aerospace

CUSIP: 05605H100

SIC: 3510

|

|

Fiscal Year

Fiscal Year End: December

Last Reported Quarter: 12/01/25

Next Expected EPS Date: 05/04/26

|

|

Share - Related Items

Shares Outstanding: 91.44

Most Recent Split Date: (:1)

Beta: 0.83

Market Capitalization: $19,795.12 (millions)

|

|

|

|

|

| |

| • EPS Information |

• Dividend Information |

| Analyst Coverage: No |

Dividend Yield: 0.46% |

| Current Fiscal Quarter EPS Consensus Estimate: $0.89 |

Indicated Annual Dividend: $1.00 |

| Current Fiscal Year EPS Consensus Estimate: $4.61 |

Payout Ratio: 0.25 |

| Number of Estimates in the Fiscal Year Consensus: 4.00 |

Change In Payout Ratio: -0.04 |

| Estmated Long-Term EPS Growth Rate: 13.27% |

Last Dividend Paid: NA - $0.00 |

| Next EPS Report Date: 05/04/26 |

|

|

|

| |